In chapter 7 bankruptcy, everything you own and owe is briefly transferred to a bankruptcy Trustee, who can then use your assets to pay your debts. If you have more debts than assets, then those debts are “discharged” or wiped out (there are exceptions for some debts… Read more »

November 4, 2021

Blog

Traffic Tickets Dischargeable in Ch. 13 Bankruptcy But Not Ch. 7

You file bankruptcy to get rid of debts you can’t afford to pay and to get the fresh financial start in life that you so desperately need. But not all debts can be wiped out in your bankruptcy. Read more »

October 25, 2021

Why I’m “Only” Assertive and Not Antagonistic

Here’s something I discuss on the landing page of my website, because I think it’s that important: I’m assertive but not antagonistic. Okay. So what? Some clients are so angry with the IRS they want to use me primarily for revenge, even if their case would have a better outcome if we approached the adversary calmly Read more »

October 13, 2021

The Statute of Limitations on IRS & FTB Tax Debt Collection

A potential client called me last week for help in dealing with the IRS. He owes taxes for 1992 to 1996. Had he filed the returns on time? Yes. Had he filed bankruptcy in the meantime? No. Had he filed an offer in compromise? No. Has he heard anything from the IRS in the last three years? No, but he thought that was because he had moved Read more »

October 4, 2021

Hard Truths for Debtors Who Procrastinate

Since the fall, I have seen a big uptick in desperate people calling me for tax or bankruptcy help. What kind of desperation? These people have been either on the IRS’s radar, or been having debt problems, for many years and then the crisis hits: the IRS puts a lien on a house, or a creditor gets a default judgment and the sheriff Read more »

September 23, 2021

Discharging Tax Debt in Bankruptcy

It’s possible to discharge (have tax debt wiped out) most federal taxes in bankruptcy. There are exceptions, however. Many of the times when taxes aren’t dischargeable in bankruptcy are very straightforward, but one is open to interpretation and thus quite murky. Read more »

September 13, 2021

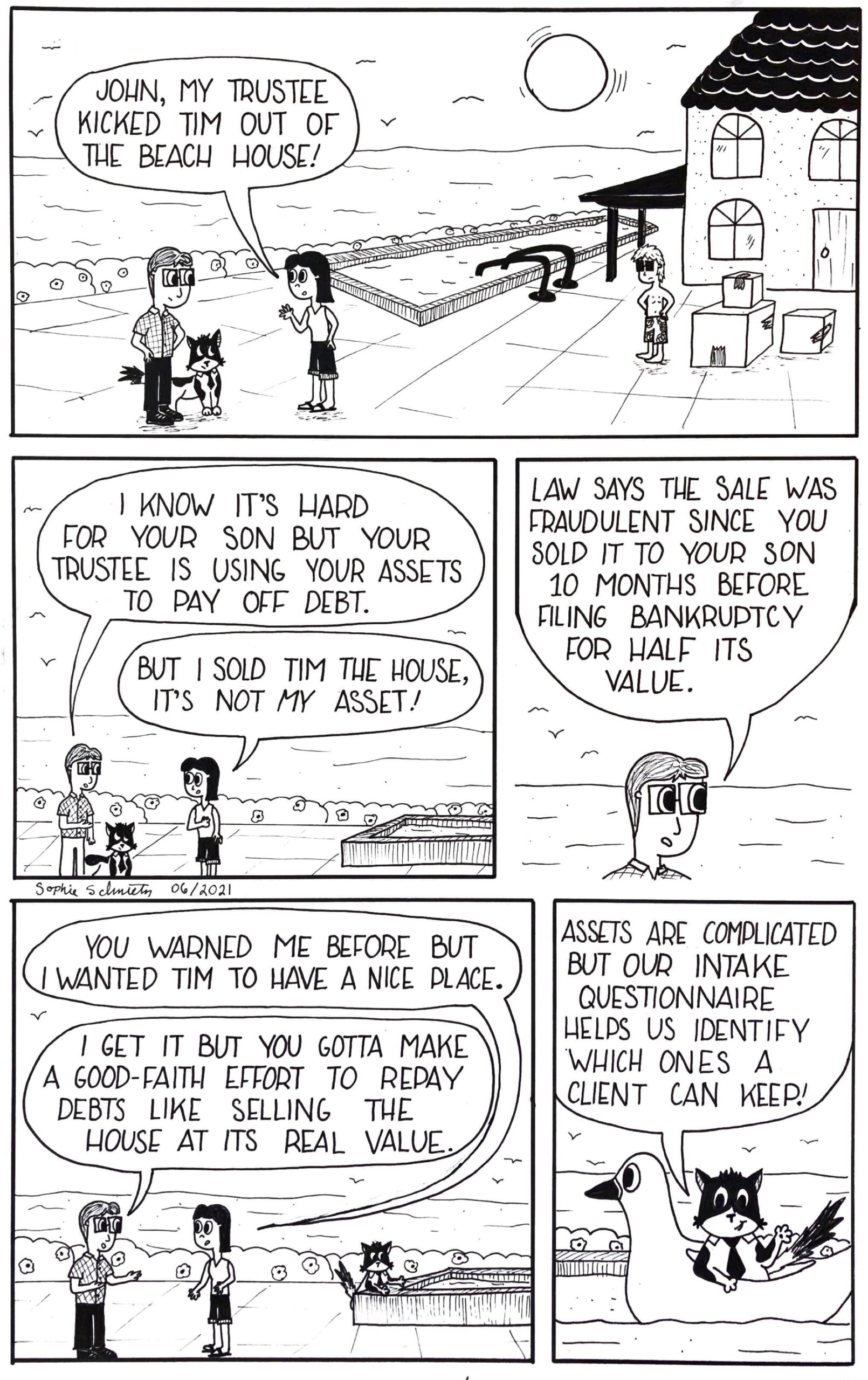

Sebastian Explains Why Selling Property for Less Than Market Value Before Bankruptcy is A No-No

If a debtor sells property for less than full market value before filing bankruptcy, the law considers this a form of theft from the bankruptcy estate: the Bankruptcy Trustee could have sold it for more money to pay off the debtor’s creditors. But, sometimes Sebastian the Feline Paralegal’s explanations are more fun to read. Read more »

September 3, 2021

The Bankruptcy Trustee

When you file a a chapter 7 bankruptcy, everything you own and owe is legally transferred to a Bankruptcy Trustee, who can then use your assets to pay your debts. Read more »

August 26, 2021

When Can You DIY an IRS Offer In Compromise?

The IRS and the FTB don’t negotiate tax debt. Neither agency will write off a dime of tax debt because the taxpayer asks it to. Their missions are to collect taxes owed equally from taxpayer, and to inflict financial pain to do so because there can’t be favoritism in collecting taxes owed. Read more »

August 17, 2021

Tax Protesters Sail on Seas of Fantasy

Is it true that there is no law requiring payment of income tax? After all, many tax protesters assert this. And, in my 10 years as an attorney for the IRS, I came across several particularly colorful protesters, including one who attempted to evade taxes by claiming he was a ship. Seriously. Read more »

August 11, 2021