IRS Tax Assessment Issues

So, you’ve received a notice from the IRS claiming you or your business owes more in taxes than was paid. You disagree. This section overviews how to dispute IRS claims that you owe more taxes, and the almost-always attendant interest and penalties the IRS tacks onto your tax bill when it claims you’ve underpaid. This section does not summarize the collection methods the IRS will use to come after you once all avenues for resolving differences over how much you owe have been exhausted.

The assessment function and the collection function of the IRS are strictly separated. The implication of this is that you can rarely challenge the amount of taxes owed unless your case is still within the IRS Assessment division. Once your audit or tax court case are completed and a final determination of taxes owed is issued, your file passes to the IRS Collection division, with the power to place levies and liens on your income and assets to satisfy your tax debt. A second implication of the strict separation between the assessment and collection divisions is that the IRS Assessment division doesn’t care if you cannot full pay the amount of tax it says you owe.

The IRS Assessment Division only cares about assessing the correct tax, not about ability to pay

Challenging the IRS is always stressful and can take years to reach resolution. It’s important you know as much as possible about this process, so I urge you to read the information on this website carefully. I believe educating and informing taxpayers and potential clients is always constructive. An educated taxpayer is better able to challenge the IRS on their own if that’s how they chose to handle their matter, or to hire a tax professional whose experience and personal style fit their needs. Please take a few minutes on this site, get yourself up to speed and, if you want more information, download my book or ask me to mail it to you.

Audits

When an individual or business files its annual tax return, it contains a calculation of the tax owed for that year. To the IRS, this is a “self-assessment.” If the IRS believes that tax figure is in error, it will either send the taxpayer a Notice of Deficiency or a letter announcing the tax return is being audited. When the IRS audits you, it is trying to find unreported income or overstated deductions so that it can assess an additional amount of money. In 2010, the IRS audited just slightly over 1 percent of tax returns; by 2020, that figure was down to 0.45 percent. Since 2010, the IRS’ budget and number of employees has fallen by 25 percent but the number of tax returns has increased almost that much. The implication is that U.S. taxpayers and businesses have never been less likely to be audited. However, if you are under audit, it is invasive and unpleasant. The IRS is mandated by Congress to treat taxpayers as guilty until they prove their innocence. In short, the burden on proof for deductions rests entirely on the taxpayer. The audit process is generally one that most individuals and small business owners (and their tax preparers) can navigate on their own; I generally step in once there’s an audit result that someone wants to fight. To learn more about the audit process and determine whether it’s something you think you can handle on your own or hand off to an experienced tax attorney, click here.

Most individuals & business owners can handle the audit themselves;

I mostly challenge & litigate bad audit outcomes

Litigation – Challenging a Bad Audit Result

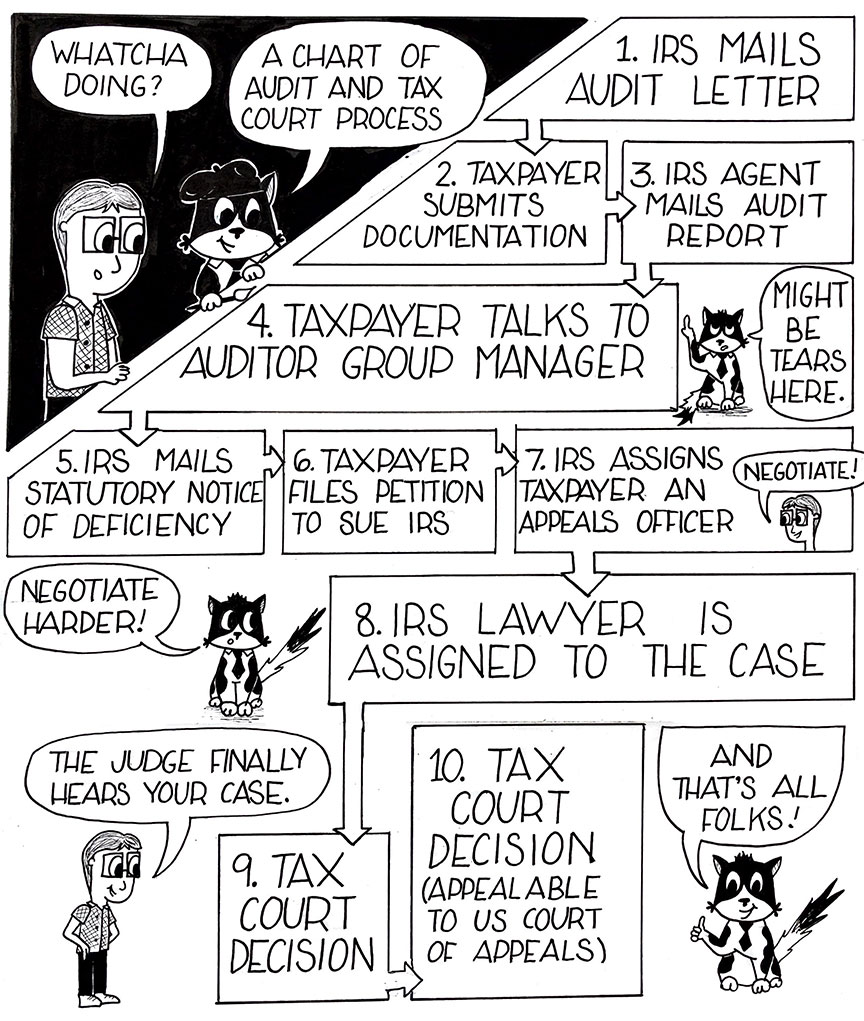

When an audit is completed, the IRS issues an Audit Report in which it either agrees with the tax return you submitted (a “no-change” letter) or, more often, it disagrees with your numbers (usually because of insufficient documentation to substantiate deductions) and proposes to assess more tax. And interest and penalties now, too. This proposal is known as the Statutory Notice of Deficiency. Once it’s issued (usually two weeks to six months after your Audit Report is completed), you are eligible to file a petition to sue the IRS in U.S. Tax Court and you should. Seriously? Isn’t that an overreaction to a bad audit result? No. In fact, the bureaucratic process is set up in such a way that your best (and almost only) avenue for appealing an audit outcome you disagree with is to file a petition in Tax Court. Filing a petition gets you access to an Appeals Officer and, if you don’t get the results you’re seeking there, then you get an IRS attorney to negotiate with. As you go up the IRS’ bureaucratic ladder, you speak to IRS employees with increasing discretion and power to alter the results of your audit. Around 1 percent of tax petitions filed actually end up being heard by a judge. Do not be intimidated by suing the IRS; it’s not a lawsuit so much as a challenge to an audit result you disagree with. However, once you formally dispute the IRS, specialized knowledge of the bureaucracy becomes more important to successful outcomes. This is why I recommend calling me or an experienced tax lawyer when you get an audit result you want to fight. Even if the fight is one you’ll handle on your own, run your case by me and let’s make sure you don’t miss something important or make a costly mistake. For more detailed information on challenging an Audit Report, click here.