Faucher Law recently hired a terrific, new Administrative Assistant. Zoe came up to me the other day and asked “John! Have you seen the IRS’ Instagram account?! And it’s quite good.” Um, no. I didn’t even know the IRS had an Instagram account. I asked Zoe to tell us what she thought about the IRS’ Instagram account. Here’s her take: Read more »

IRS

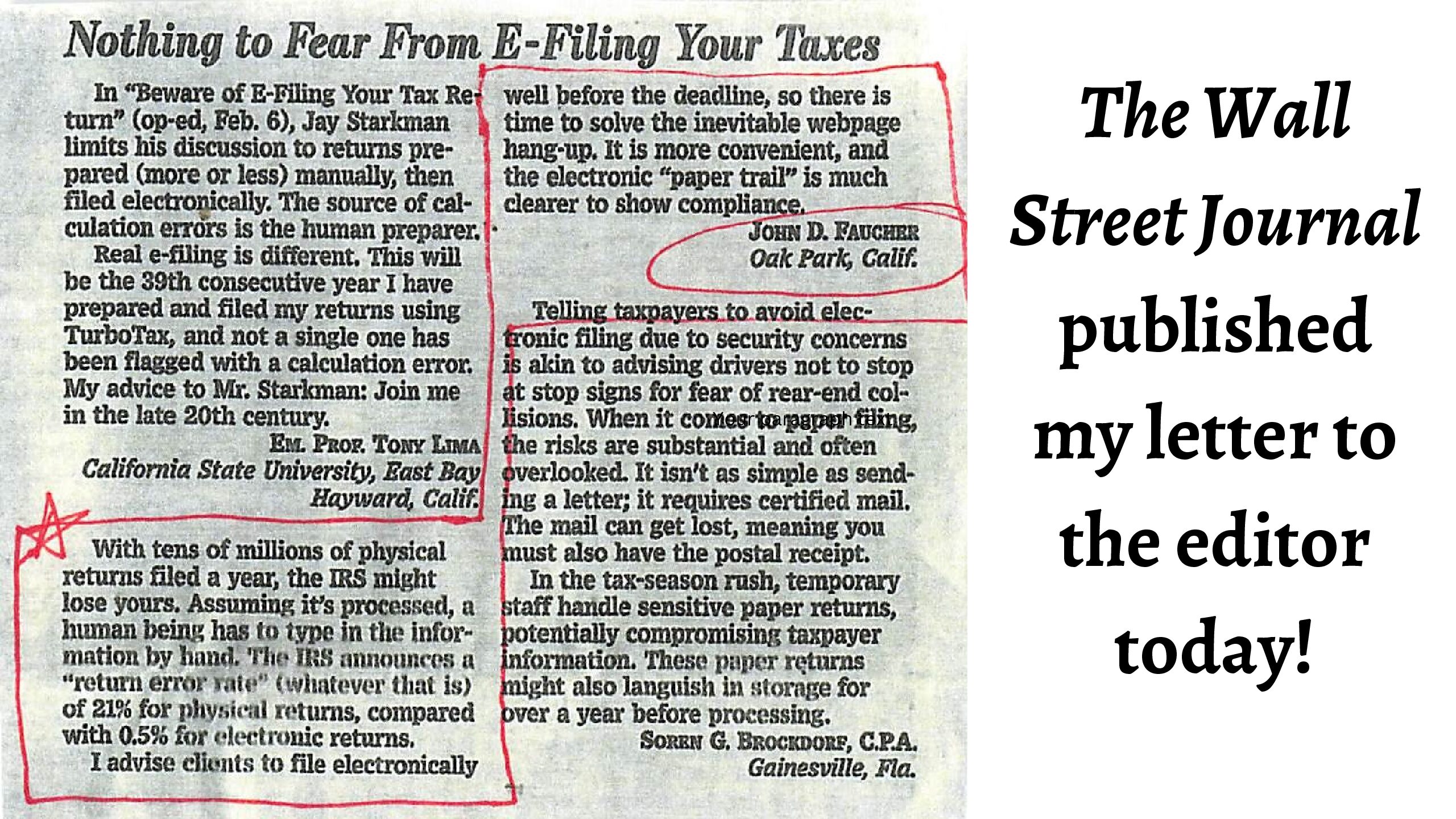

John Faucher Published in Wall Street Journal Today!

The Wall Street Journal published me in their Letters to the Editor section today (February 14, 2024:A14)! I was responding to a February 5th Op-Ed by Jay Starkman, telling taxpayers to avoid filing their tax returns electronically. I strongly disagree. Read more »

Why was the 2022 Tax Deadline for California Extended on Deadline Day?

In January, the IRS extended the tax return filing deadline to October 16th due to the unusually heavy precipitation last winter. Why did the IRS wait to announce the new November 16 deadline until deadline day? Wouldn’t almost everyone still needing to file on Monday have done so? Moreover, the IRS’ stated reason for this third extension is still the winter weather – which ended a half year ago! C’mon, IRS! This latest deadline IS NOT about generously giving Californians impacted by winter weather more time to file. It’s about CYA for the IRS. Read more »

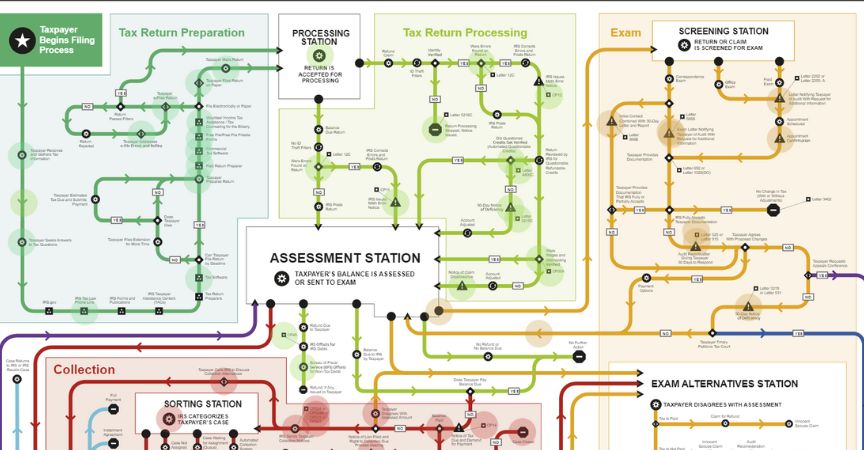

Tax Lawyers Are GPS For the IRS

People hire me because tax lawyers are like GPS for the IRS. Think you can navigate the steps in the Taxpayer Roadmap above on your own? Good luck! Looks like the subway map for NYC, right? How easy was it for you to find your way around the NYC subway system the first time you rode it? Even with a map, I’ll bet it was a challenge. The same is true of navigating the vast, intimidating bureaucracy of the IRS depicted above Read more »

IRS Offer in Compromise Hard to Get in Santa Barbara County

An Offer-in-Compromise is a contract between the IRS and a taxpayer to settle a tax debt for less than what is owed. I get lots of calls from folks excited at the prospect of being able to negotiate down what they owe IRS. And then I burst their bubble with the bad news: it is very hard to get an Offer in Compromise (OIC) from the IRS. Read more »

Is the IRS Audit in Everything Everywhere All at Once Accurate?

Everything Everywhere All at Once won seven Oscars at the 95th Academy Awards including for Best Picture. The movie begins with the havoc unleashed by IRS Agent Deirdre Beaubeirdra (Jamie Lee Curtis won Best Supporting Actress), when she audits the laundromat of Evelyn & Waymond Wang (Michelle Yeoh won Best Actress and Ke Huy Kwan won Best Supporting Actor. But are the audit scenes realistic? Short answer: yes, but mostly no. Here’s how the movie differs from a real-life IRS audit. Read more »

Top Five Reasons to Hire a Tax Lawyer in Alameda County

You received an audit notice from the IRS. Or maybe you’ve already been audited and hate the result. Or you ignored audit notices, and now the IRS has put a lien on your house and levied your accounts. Here’s the top five reasons to hire a tax attorney, rather than handle a tax problem on your own. Read more>>

How to Request IRS Uncollectible Status in Ventura County

You owe taxes. But you can’t pay. You’re barely making ends meet with basic living expenses. Especially in high cost-of-living places like Agoura Hills, Thousand Oaks, Oxnard and Ventura. You don’t want to file for bankruptcy, or you don’t qualify (some taxes can be discharged in bankruptcy). If you have few assets and modest income, then ask the IRS for Uncollectible Status. Read more>>

IRS Presidential Audits Not a Mandate, Only a Norm

As I sit in my Westlake Village tax law office , I’m contemplating the remarkable story that broke this week about the IRS failing to audit former President Trump during the first two years of his Presidency, despite Read more »

It’s Unlikely Trump Triggered Comey’s IRS Audit

Did former President Trump unleash the IRS on political foes Jim Comey and Andrew McCabe? The question is back in the news. Trump’s former Chief of Staff, General John Kelly, says Trump demanded the FBI Commissioners be punished with audits. Read more>>