Los Angeles, Ventura, and Santa Barbara County Bankruptcy Law Specialist

John D. Faucher is certified by the State Bar of California as a Bankruptcy Law Specialist, a designation earned by fewer than five percent of California attorneys. The California Board of Legal Specialization requires an attorney seeking this specialization to (1) pass a written examination in Bankruptcy Law, (2) demonstrate a high level of experience in Bankruptcy Law having practiced for at least five years continuously with at least 25 percent of case focus in the specialization, (3) fulfill ongoing continuing legal education requirements higher than those for normal Bar certification, and (4) be favorably evaluated by other attorneys and judges familiar with the attorney’s work in the specialty area of bankruptcy law. Visit the California Board of Legal Specialization for more information.

John D. Faucher is certified by the State Bar of California as a Bankruptcy Law Specialist, a designation earned by fewer than five percent of California attorneys. The California Board of Legal Specialization requires an attorney seeking this specialization to (1) pass a written examination in Bankruptcy Law, (2) demonstrate a high level of experience in Bankruptcy Law having practiced for at least five years continuously with at least 25 percent of case focus in the specialization, (3) fulfill ongoing continuing legal education requirements higher than those for normal Bar certification, and (4) be favorably evaluated by other attorneys and judges familiar with the attorney’s work in the specialty area of bankruptcy law. Visit the California Board of Legal Specialization for more information.

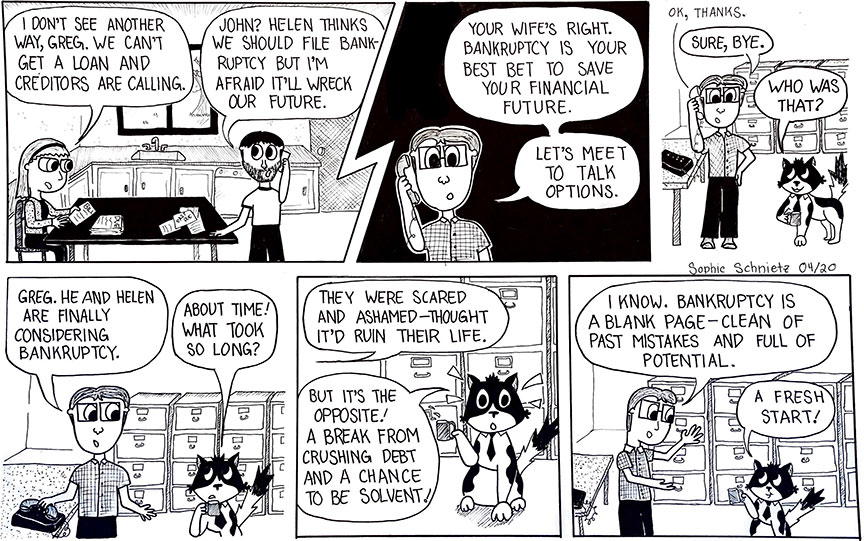

As a Bankruptcy Law Specialist serving all of California, but particularly Los Angeles, Ventura and Santa Barbara counties, John can help you or your business in the following ways:

- Analyze your financial situation and explain your legal rights and options

- Take steps to stop or delay levy lawsuits, garnishments, tax levies, foreclosures, and other collections actions

- Vigorously represent you through all stages of the bankruptcy process, including defending you against creditors

- Assist you in reorganizing business or personal debt, and help you or your business get a fresh start

- Protect your rights as a debtor or creditor in bankruptcy litigation

Types of Bankruptcy

Types of Bankruptcy

Our lawmakers realized long ago that Americans sometimes run up against bad luck or circumstances that make them unable to pay their bills. They need a way to start over financially. Congress offers several ways for individuals to get out from under burdensome debts.

Chapter 7 Personal Bankruptcy

This type of bankruptcy is intended for individuals with relatively few assets, many debts and low to moderate income. In general, a chapter 7 will allow to you keep most of your assets (car, clothing, household goods and between $300,000 – $600,000 of equity in a home) and will wipe out most debts, particularly credit card and medical debt, but sometimes also tax debt and legal judgments. Businesses are also eligible for chapter 7 bankruptcy, however, we rarely recommend business owners file bankruptcy for the company. We almost always take the business owner through a personal chapter 7 instead because they have often taken out personal loans or second mortgages, or taken on a lot of personal debt, in an attempt to keep their struggling business alive.

Chapter 7 Business Bankruptcy

As with individuals struggling with debt, businesses are also eligible for chapter 7 bankruptcy. However, I rarely recommend business owners file bankruptcy for the company. Instead, I almost always take the business owner through a personal chapter 7 instead. Why? The most important reason is that a chapter 7 for a business does not wipe out the business’ debt. It simply puts a Trustee in charge of the debts. That’s a cost and hassle most business owners don’t need. You and I can easily wind down a failing company. What most small business owners do need, however, is a personal chapter 7 bankruptcy because they have often taken out personal loans or second mortgages in an attempt to keep their struggling business alive.

Chapter 11 Small Business Bankruptcy

Until February 2020, chapter 11 Bankruptcy made sense only for very large corporations. Indeed, almost no businesses with less than $10 million in debt ever filled chapter 11 because it was too expensive and cumbersome to be financially useful. Indeed, the lack of a good small business bankruptcy option is exactly why Congress passed the Small Business Reorganization Act in 2019 which modified existing chapter 11 bankruptcy rules for small businesses. Until February 2021, any business with debt under $7.5 million qualifies for a “fast-tracked” small business chapter 11. After February 2021, businesses with debt under $2.7 million qualify for this special small business chapter 11 bankruptcy.

Chapter 13 Bankruptcy

Chapter 13 Bankruptcy is used when someone doesn’t qualify for a chapter 7. In general, if you have a lot of assets to protect, such as more than $300,000 – $600,000 in equity in a house, or if your income is more than about $101,315 annually for a family in California (or $60,360 a single person), then you cannot file a chapter 7. Instead, you qualify for a chapter 13 bankruptcy. Chapter 13 differs from chapter 7 in three main ways. First, you are put on a five-year repayment plan, where any income above basic living expenses (as determined by the bankruptcy court) go to your debtors. Second, any remaining debts at the end of five years are wiped out. Approximately half of chapter 13 bankruptcies end with the debtor having fully paid their debts, and half having the remaining debt forgiven. Third, the bankruptcy Trustee and Court will demand extensive documentation and proof of all aspects of your finances not just once, as in a chapter 7, but multiple times during the five-year plan.

Bankruptcy Litigation

John D. Faucher knows bankruptcy law from both the debtor and the creditor side. If someone owes you money that you think should not be discharged in bankruptcy, John knows the process for getting this done. He also understands collection law and has excellent relationships with several attorneys who handle these matters on an ongoing basis. His results include:

- Pursuing a debtor through two bankruptcy cases and a judicial foreclosure action in state court, collecting $800,000

- Settling a nondischargeability claim against a mortgage broker for fraud by payment of $200,000

- Upholding a $700,000 fraud judgment on appeal

If you have a mad dog creditor who wants to deny your discharge, he has worked on cases like this as well. His results include:

- Defending landlord at trial against tenant’s claim that $30,000 of rents paid over five years was obtained by fraud, resulting in a verdict of dischargeability

- Defending freight broker against truck drivers’ claims that $100,000 of unpaid shipping fees were a “trust fund” and not dischargeable in bankruptcy. Complaint dismissed before any further legal process