Many of my tax clients come to me after being scammed by a “tax relief” firm. These bottom-feeding scammers simply take the money and then do nothing: don’t return phone calls or emails, don’t do any work. The tens of thousands of dollars they take from people seems only to be invested back into the marketing and sales machinery of these scam firms: buying more radio, television and google ads, and hiring more salespeople to sign up unsuspecting consumers. Here’s what to do when you’re hood-winked by one of these “Opti-con” tax “resolution” firms. Read more »

Tax Resolution Services

IRS Offer in Compromise Hard to Get in Santa Barbara County

An Offer-in-Compromise is a contract between the IRS and a taxpayer to settle a tax debt for less than what is owed. I get lots of calls from folks excited at the prospect of being able to negotiate down what they owe IRS. And then I burst their bubble with the bad news: it is very hard to get an Offer in Compromise (OIC) from the IRS. Read more »

Top Five Reasons to Hire a Tax Lawyer in Alameda County

You received an audit notice from the IRS. Or maybe you’ve already been audited and hate the result. Or you ignored audit notices, and now the IRS has put a lien on your house and levied your accounts. Here’s the top five reasons to hire a tax attorney, rather than handle a tax problem on your own. Read more>>

When Can You DIY an IRS Offer In Compromise?

The IRS and the FTB don’t negotiate tax debt. Neither agency will write off a dime of tax debt because the taxpayer asks it to. Their missions are to collect Read more »

Problems with the IRS? Who are you gonna call?

Katie Clunen is a terrific family law attorney in Westlake Village. Tax issues often arise when couples divorce, so Katie and I often need to speak. In this short Vlog, Read more »

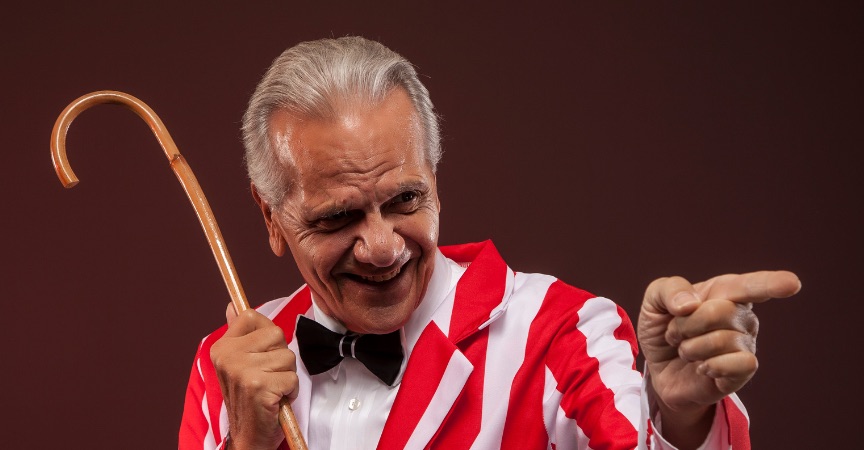

Beware Ads Promising To Get Rid Of IRS Tax Debt

“We Can Lower Your Tax Debt by 50, 70 Even 90 Percent!!!” Ads like this are highly misleading. I have many clients who go first to the hucksters pedaling such Read more »

Tax Resolution Firms: Do Your Homework!

A business owner sent me an email about her tax issues: she owes lots of money, the IRS has filed lien notices, she can’t make her payments. Her CPA recommended Read more »

Tales From the Tax Troll Trenches: Tax Refund Majorly “Stuck”

When the IRS and the California state tax agencies do particularly bone-headed things, it’s time for another tale from the tax troll trenches. Here’s one that reminded me of why the Read more »