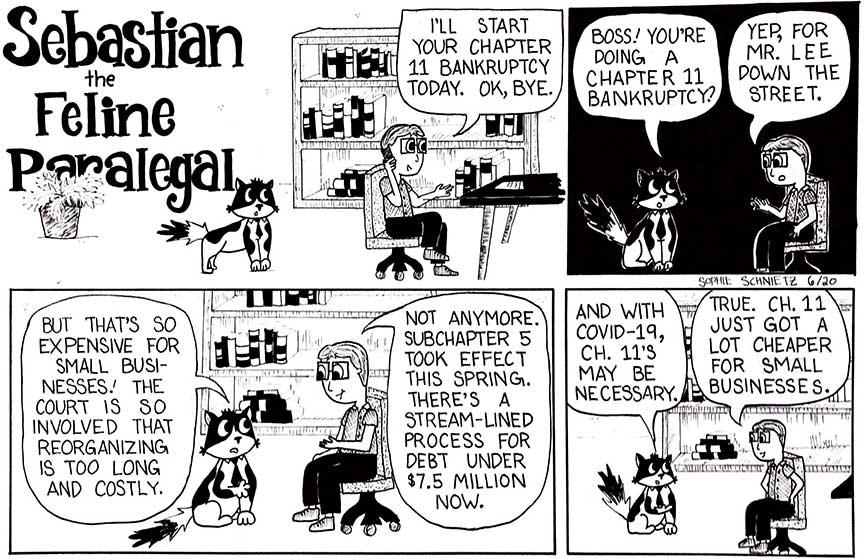

Chapter 11 Small Business Bankruptcy

Chapter 11 Business Bankruptcy Changed in 2020, under New Subchapter V Rules

Chapter 11 was intended to help struggling firms stay alive, by reorganizing debts and thus giving firms more time to pay creditors. However, it was intended for big corporations and has never worked well for small firms. That’s why Congress passed the Small Business Reorganization Act in 2019, which went into effect in February 2020. Coincidentally, it went into effect just as the pandemic hit. The Small Business Reorganization Act, also called subchapter 5, is targeted at businesses with less than $2.7 million in debt, though as part of the CARES Act addressing the economic fallout of the pandemic, the debt threshold is being raised to $7.5 million for one year. I have historically counseled most small business owners to use personal rather than business bankruptcy. But that’s changed with the new subchapter 5 process that’s made chapter 11 much cheaper and easier.

Why is Regular Chapter 11 So Expensive?

When a company files chapter 11, its assets become part of a newly-created estate that the court administers. This means the estate/firm cannot pay any expenses without an (expensive) attorney filing a motion and obtaining (slow) court approval. Moreover, since attorneys generally are not allowed to withdraw from chapter 11 cases for more nonpayment of fees, they must secure the entirety of their fee upfront, or risk not being paid. Most attorneys I know ask for at least $50,000 to start a chapter 11. Few struggling small businesses have this.

Creditors No Longer Vote to Confirm Plan in Subchapter V

In any chapter 11, the debtor creates a plan outlining their projected income and how they’ll repay creditors. In a regular chapter 11, creditors vote on this reorganization plan, often blocking plans and requiring multiple plan modifications. It’s very adversarial. In subchapter 5, a plan can be confirmed even without acceptance by creditors, as long as the court deems the plan to be “fair and equitable” (based on existing criteria on how to treat secured and unsecured creditors). This makes the process much more debtor-friendly. Creditors must receive as much under subchapter 5 as they would if the firm were liquidated in a chapter 7. Subchapter 5 also allows the debtor to contribute all projected disposable income to plan payments for 3-5 years.

No More Separate Disclosure Statement in Subchapter V

In a regular Chapter 11 the debtor must provide a disclosure statement to explain the plan, but creditors may object to the detail and disclosure in that statement, and the court must approve the disclosure statement. Only then may a debtor solicit votes in favor of its plan, and the confirmation occurs several weeks to months later. In Subchapter 5, the plan contains all the required disclosures; there is no separate disclosure statement. This saves time and thus money.

“Absolute Priority Rule” No Longer Applies in Subchapter V

The “absolute priority rule” does not apply in Subchapter 5. This rule says that an equity holder cannot keep their interest in the firm if the plan does not pay the general unsecured debts in full. It’s arcane, but this rule places a huge roadblock in reorganizations. Removing it vastly changes the balance of power between creditors and debtors, in the debtors’ favor.

The subchapter 5 process is much easier and faster than standard Chapter 11 bankruptcies, opening new possibilities for small firms. If you have a business that is not doing well.

Call me and let’s discuss your new options

I am a Bankruptcy attorney serving all of California, with a strong concentration in Los Angeles, Ventura, and Santa Barbara counties, certified by the State Bar of California as a Bankruptcy Law Specialist, a designation earned by fewer than five percent of California attorneys.

Contact me today so I can learn more about your situation and educate you on your options.