Before I started at Faucher Law, I was finishing up my MSA (master of science in accounting) at San Diego State University. When I used to tell people about my accounting background, they asked if I liked tax, and my answer was always NO! Now here I am, half a year later, switching my answer: I kind of love tax! Listed below are the most surprising things I have learned at my time at Faucher Law and how they have changed my perspective on tax and bankruptcy.

Bankruptcy

Celebrity Bankruptcy

You’d be surprised how many famous people, whom we consider wildly successful, have gone through financial turmoil and bankruptcy. Many of them went on to be wildly successful after bankruptcy. Read more »

341 Meeting Questions You’ll Be Asked

Wondering what you might be asked in a 341 Meeting of the Creditors? This Chapter 7 meeting with trustees and creditors can loom large in the minds of some of my clients. Let me demystify what you’ll have to answer in this quick, painless meeting. Read more »

Should I Cash In Retirement Accounts to Pay off IRS or Credit Card Debt?

In a word: NO!!! Please: NO! You should never sacrifice your financial security in retirement to pay current debt. Most importantly, bankruptcy allows you to erase credit card and (most) tax debt and keep your retirement accounts. So why would anyone cash in retirement accounts they will need in the future to pay off today’s debts, if today’s debts can be discharged in bankruptcy? Because most people don’t know better. Read more »

California Bankruptcy Trustees’ Document Portals Ranked

California Bankruptcy Trustees document portals should be ranked. And I’m doing so here, in the first annual Faucher Law ranking of bankruptcy document portals! The Bankruptcy Trustee overseeing a chapter 7 bankruptcy always requires several kinds of documents substantiating the bankruptcy petition to be submitted. This is done via web portals. But not all portals were created equal: some are easy to use and some are downright terrible. Thus, the “need” for a portal assessment. Read more »

Are You A Consumer or A Non-Consumer Debtor?

When filing a Chapter 7 bankruptcy in California, it’s important to know if you’re a consumer or a non-consumer debtor. If you’re a consumer debtor, then you need to meet the Means Test, an income threshold you cannot go above and still qualify for a chapter 7. If you’re a non-consumer debtor, then you do not need to meet the Means Test; how much you earn may, but won’t necessarily, disqualify you from filing for Chapter 7. So what? Most everyone would prefer a chapter 7 to be free and clear of their debts without going through years of repayment first. Read more »

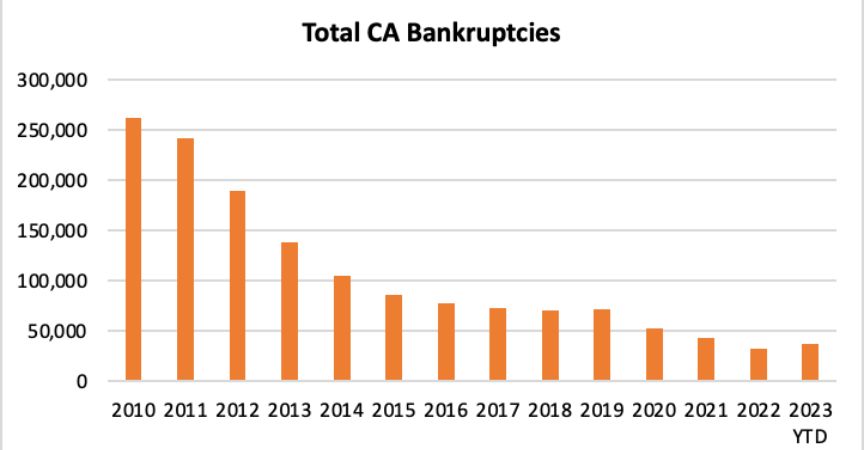

Why Are Bankruptcies Increasing?

Why are bankruptcies increasing? The trend is clear both nationwide and in California (the two track each other closely): after having declined every year since 2010, the high-water mark of Great Recession bankruptcy filings, bankruptcies are going up again. Read more »

Your Credit Score May Go Up When You File Bankruptcy in LA

Most of my clients are surprised when I tell them their credit score may go up when they file bankruptcy. In fact, one of the Top Three Fears of Bankruptcy I hear from clients is the negative impact it’ll have on their credit scores. This is the case especially for renters since so many property management firms and landlords check a potential tenant’s credit score before renting. Read more »

California State Bar Certificates of Specialization

As many of you may know, I hold a Certificate of Specialization in Bankruptcy Law and in a Certificate of Specialization in Tax Law from the State Bar of California. You probably also don’t see many California attorneys advertising this. That’s because fewer than five percent of lawyers in California have taken the exam and continuing legal education courses necessary to obtain this certificate. Read more »

What Happens to California Homes with IRS Liens in Bankruptcy?

Many debtors in California file chapter 7 bankruptcy with a home that has an IRS tax lien on it. What happens in these cases? If the IRS has a federal tax lien on real property in California prior to a bankruptcy being filed, then that lien will survive bankruptcy. In other words, debtors cannot use bankruptcy to escape an existing federal tax lien on a California property, despite the fact that California bankruptcy law allows chapter 7 filers to take up to $678,000 in equity in a primary residence through bankruptcy. Read more »