Many of my tax clients come to me after being scammed by a “tax relief” firm. These bottom-feeding scammers simply take the money and then do nothing: don’t return phone calls or emails, don’t do any work. The tens of thousands of dollars they take from people seems only to be invested back into the marketing and sales machinery of these scam firms: buying more radio, television and google ads, and hiring more salespeople to sign up unsuspecting consumers. Here’s what to do when you’re hood-winked by one of these “Opti-con” tax “resolution” firms. Read more »

Taxes

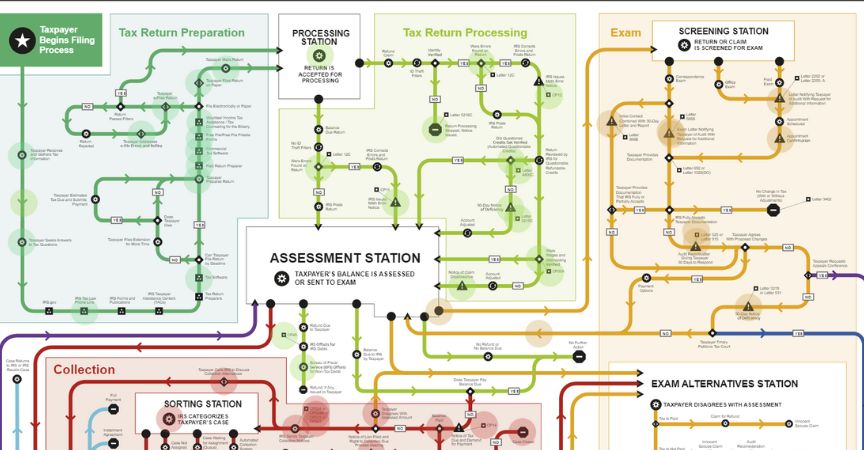

Tax Lawyers Are GPS For the IRS

People hire me because tax lawyers are like GPS for the IRS. Think you can navigate the steps in the Taxpayer Roadmap above on your own? Good luck! Looks like the subway map for NYC, right? How easy was it for you to find your way around the NYC subway system the first time you rode it? Even with a map, I’ll bet it was a challenge. The same is true of navigating the vast, intimidating bureaucracy of the IRS depicted above Read more »

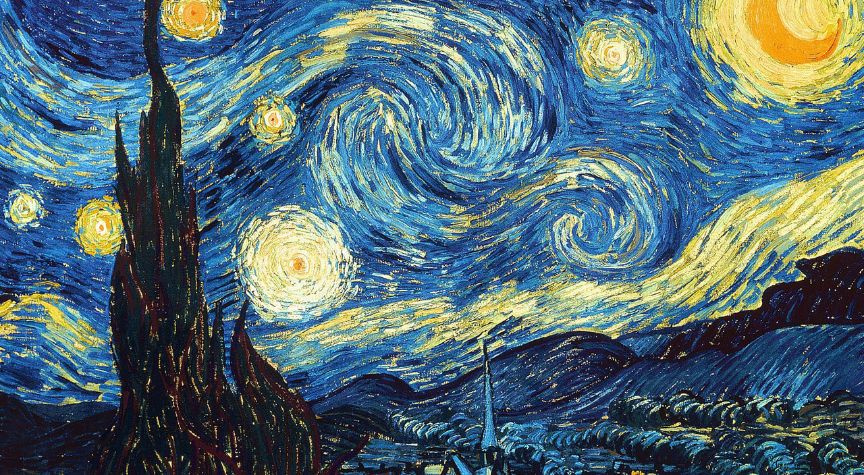

Are There Limits to Tax-Deductibility of Fine Art Donations by Artist?

Many thanks to my seatmate on a recent flight who posed this hypothetical question, worthy of a Harvard Law School Professor: if an artist sells her painting for $1 million, can she then paint an identical copy, donate it to a charity, and claim no income for the tax year, on the assumption that the value of the copy is $1 million (because that’s what she sold the original for)? The answer is “no.” Read more »

California State Bar Certificates of Specialization

As many of you may know, I hold a Certificate of Specialization in Bankruptcy Law and in a Certificate of Specialization in Tax Law from the State Bar of California. You probably also don’t see many California attorneys advertising this. That’s because fewer than five percent of lawyers in California have taken the exam and continuing legal education courses necessary to obtain this certificate. Read more »

IRS Offer in Compromise Hard to Get in Santa Barbara County

An Offer-in-Compromise is a contract between the IRS and a taxpayer to settle a tax debt for less than what is owed. I get lots of calls from folks excited at the prospect of being able to negotiate down what they owe IRS. And then I burst their bubble with the bad news: it is very hard to get an Offer in Compromise (OIC) from the IRS. Read more »

California’s Franchise Tax Board’s Most Wanted List

California’s Franchise Tax Board (FTB) publishes a Most Wanted List of delinquent California taxpayers on its website, for both individuals and corporations. The FTB’s Most Wanted List includes the taxpayer’s name, address and amount owed. In order to qualify for placement, a taxpayer must owe the FTB at least $100,000. Read more »

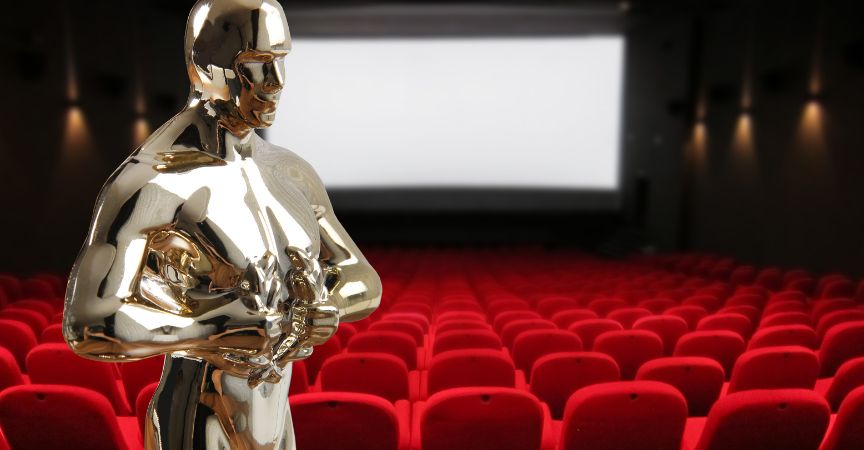

Is the IRS Audit in Everything Everywhere All at Once Accurate?

Everything Everywhere All at Once won seven Oscars at the 95th Academy Awards including for Best Picture. The movie begins with the havoc unleashed by IRS Agent Deirdre Beaubeirdra (Jamie Lee Curtis won Best Supporting Actress), when she audits the laundromat of Evelyn & Waymond Wang (Michelle Yeoh won Best Actress and Ke Huy Kwan won Best Supporting Actor. But are the audit scenes realistic? Short answer: yes, but mostly no. Here’s how the movie differs from a real-life IRS audit. Read more »

Top Five Reasons to Hire a Tax Lawyer in Alameda County

You received an audit notice from the IRS. Or maybe you’ve already been audited and hate the result. Or you ignored audit notices, and now the IRS has put a lien on your house and levied your accounts. Here’s the top five reasons to hire a tax attorney, rather than handle a tax problem on your own. Read more>>

IRS Assessment Vs. Collections Divisions

Most people don’t know that the IRS is broken into two, almost separate halves: the Assessment Division and the Collections Division. So what? Who cares about the IRS’s Org Chart? You should care. Because that division has a lot of implications for taxpayers. Read more>>

Section 1031 Exchanges to Defer Capital Gains Tax

Rising real estate prices create tax problems for owners selling property. While it’s great to sell at high prices, it’s also discouraging to pay big capital gains taxes on the proceeds. That “gain” – the difference between sales proceeds and the adjusted basis in the property (the amount paid for it originally) can be deferred with Section 1031 exchanges. But the rules are complex. Read more>>