What happens to cars (and car notes) in bankruptcy? After all, almost everyone filing bankruptcy has a car and it is often one of the larger assets a debtor owns. The answer depends largely on how much equity the debtor has in the vehicle. Read more »

Pre-Bankruptcy Planning

Should I Cash In Retirement Accounts to Pay off IRS or Credit Card Debt?

In a word: NO!!! Please: NO! You should never sacrifice your financial security in retirement to pay current debt. Most importantly, bankruptcy allows you to erase credit card and (most) tax debt and keep your retirement accounts. So why would anyone cash in retirement accounts they will need in the future to pay off today’s debts, if today’s debts can be discharged in bankruptcy? Because most people don’t know better. Read more »

Are You A Consumer or A Non-Consumer Debtor?

When filing a Chapter 7 bankruptcy in California, it’s important to know if you’re a consumer or a non-consumer debtor. If you’re a consumer debtor, then you need to meet the Means Test, an income threshold you cannot go above and still qualify for a chapter 7. If you’re a non-consumer debtor, then you do not need to meet the Means Test; how much you earn may, but won’t necessarily, disqualify you from filing for Chapter 7. So what? Most everyone would prefer a chapter 7 to be free and clear of their debts without going through years of repayment first. Read more »

What Happens to California Homes with IRS Liens in Bankruptcy?

Many debtors in California file chapter 7 bankruptcy with a home that has an IRS tax lien on it. What happens in these cases? If the IRS has a federal tax lien on real property in California prior to a bankruptcy being filed, then that lien will survive bankruptcy. In other words, debtors cannot use bankruptcy to escape an existing federal tax lien on a California property, despite the fact that California bankruptcy law allows chapter 7 filers to take up to $678,000 in equity in a primary residence through bankruptcy. Read more »

How Long Does A Chapter 7 Bankruptcy Take in Thousand Oaks?

My clients often ask: how long does a Chapter 7 bankruptcy take? The short answer: it depends. It depends on how quickly the client organizes their information and documents; it depends on whether it makes sense to postpone filing to protect some assets that would be otherwise taken; and it depends on the Bankruptcy Trustee. I rarely have a bankruptcy take less than 4 months or longer than 8 months. The average is 5-6 months. Read more »

How To Lose A California House with An IRS Tax Lien in Bankruptcy

California increased the home equity people going through bankruptcy could keep in 2020: from $175,000 to $600,000, specifically so debtors wouldn’t lose their house in bankruptcy. It mostly works. Except with houses that have IRS tax liens on them.Read more>>

Why Bankruptcy Attorneys Shouldn’t Accept Credit Cards

I don’t take credit cards. I don’t think it’s ethical, and here’s why Read more »

Hard Truths for Debtors Who Procrastinate

Since the fall, I have seen a big uptick in desperate people calling me for tax or bankruptcy help. What kind of desperation? These people have been either on the IRS’s radar, or been having debt problems, for many years and then the crisis hits: the IRS puts a lien on a house, or a creditor gets a default judgment and the sheriff Read more »

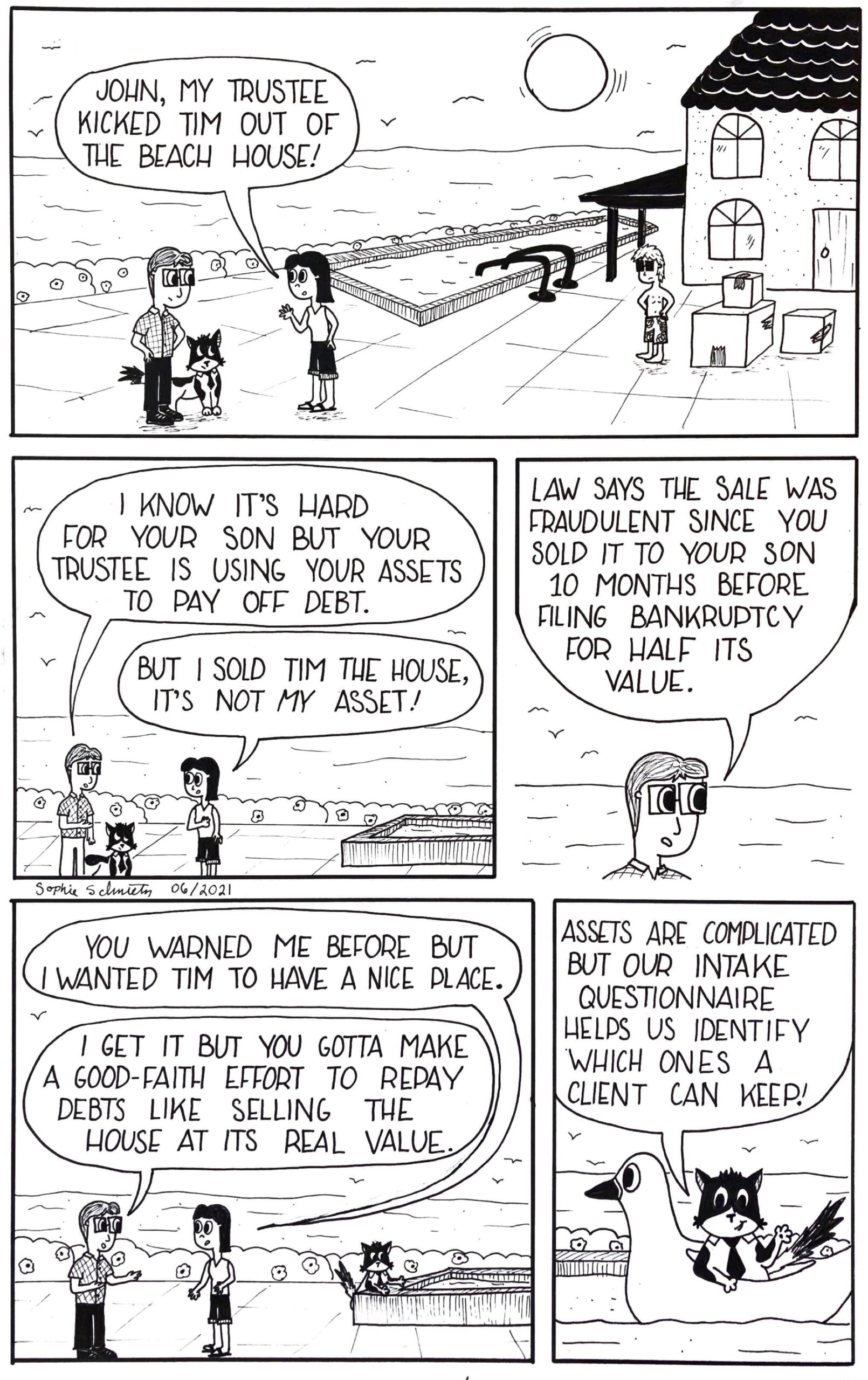

Sebastian Explains Why Selling Property for Less Than Market Value Before Bankruptcy is A No-No

If a debtor sells property for less than full market value before filing bankruptcy, the law considers this a form of theft from the bankruptcy estate: the Bankruptcy Trustee could have sold it for more money to pay off the debtor’s creditors. But, sometimes Sebastian the Feline Paralegal’s explanations are more fun to read.

Considering Bankruptcy? Tip 7 – Get Out of Denial

There’s an almost rapturous feeling that my bankruptcy clients feel when they hear “discharged” about their debts in a Chapter 7 bankruptcy case. It’s a feeling like that which Renee Read more »