California State Tax Issues

Overview

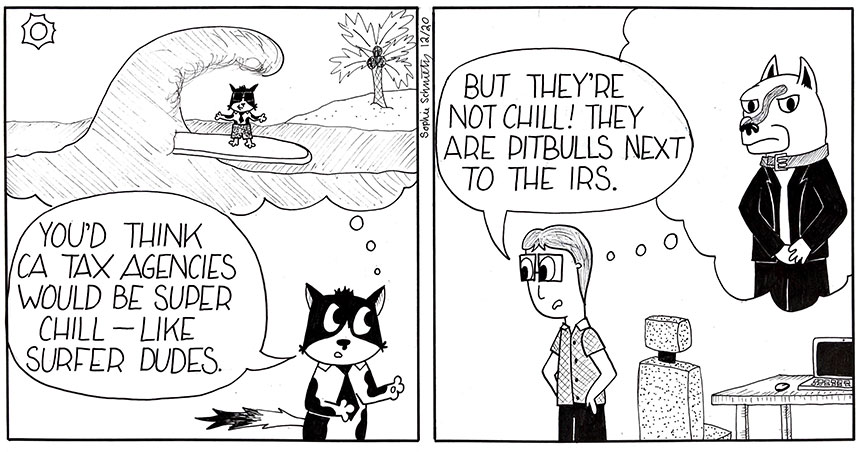

Compared to the IRS, California’s three tax authorities are more aggressive and disorganized, and less transparent and reasonable. The processes and tactics they use to collect back taxes are less “polite”, and there are fewer recourses to prevent abuse of power. Indeed, I have seen these agencies take illegal positions on audits and get away with it. Why? Because it almost always costs the taxpayer (my client) more to fight than to simply pay what the agency says is owed. I believe the agencies exploit this reality to maximize revenue collection. While I much prefer to deal with the IRS on tax disputes, many clients generally need me more for disputes with the California tax authorities because these bureaucracies are more difficult to understand and navigate, and because they take more unreasonable positions. Let’s look at them in order of ease to deal with, from most easy to least.

California’s Tax Agencies – FTB, CDTFA & EDD – are much more aggressive than the IRS, much less transparent, and far more frustrating to deal with

Franchise Tax Board (“FTB”)

California State Income Tax

The FTB is the easiest of the California agencies to deal with, although it’s not an easy agency, especially compared to the IRS. The FTB has a broader mandate (administering the state’s income tax) than the CDTFA (state sales tax) and the EDD (state disability and unemployment payroll taxes), and one which touches every individual and business in the state. In contrast, the CDTFA and EDD administer only business-related taxes. This broader mandate makes the FTB a bit more transparent in its processes and structure than the other two tax agencies. But it’s still a bear (a California bear?) to deal with the FTB.

FTB Audit Trigger. The FTB has a system that triggers tax returns for audit similar to that of the IRS: it looks for particular deductions and income categories that fall outside of a broad average (click here to read more about the IRS’s DIF score). But that’s where the similarities end.

While most individuals and small businesses can handle an IRS audit on their own, I don’t recommend going into an FTB audit or appeal without an experienced tax attorney. Why? FTB focuses disproportionately on high-dollar or complicated deductions or transactions. I tell potential clients when I think they can do something on their own, or with just a bit of coaching. And I’m telling you: most “civilians” will not get a good FTB result without an experienced tax attorney. Since revenue maximization is the FTB agent’s primary objective (rather than administering tax law correctly and fairly, which is the IRS’s mandate), the FTB agent will rarely back off an audit result unless there’s strong case law to support the taxpayer’s position. Of course, you wouldn’t know this by simply visiting the FTB’s Audit website; the way the process is laid out there seems kind and simple. It’s not. Call me if you’re facing an FTB audit or need to appeal one. I’ll tell you if I think you have a winning chance. However, the reality is that the FTB is very aggressive and intransigent because it knows it’s less expensive for most taxpayers to give up and simply pay what the FTB says they owe, than to take the issue to the Office of Tax Appeals and then California Superior Court.

FTB Audit Appeal. When the FTB completes an audit, it sends a Notice of Proposed Assessment (“NOPA”) by 1st class mail only to the taxpayer (it will not send a NOPA to an attorney, accountant or someone who has power of attorney for you), in contrast to the IRS which sends this notice by certified mail. For more details on the IRS Audit process, click here. The taxpayer has 60 days to either accept the NOPA or appeal the auditor’s decision. If a taxpayer is unhappy with the Appeals Officer’s decision, then s/he can request a hearing with the Office of Tax Appeals. Finally, if the taxpayer is unhappy with the OTA’s decision, s/he can file a case in Superior Court. Approximately 95 percent of challenges to FTB audits are settled at the Appeals Officer stage; about 5 percent go on to the Office of Tax Appeals, and only a handful are litigated annually in Superior Court.

As with the IRS, as a taxpayer moves up the FTB appeals bureaucracy, s/he encounters FTB employees with increasing discretion to alter the results of the audit. However, unlike the IRS, moving up the FTB Appeals hierarchy is not nearly as likely to result in a favorable outcome. First, since the state of California cannot print money (unlike the U.S. Treasury), the FTB must collect tax dollars to fund all the services of the state. It is very unwilling to give in on most disputes as a result – California needs this revenue to fund operations. Second, FTB appeals officers have an inferiority complex. Why? Most taxpayers fear the IRS more than the FTB, and FTB officials know it and resent it. In my experience, many FTB officers want equal “respect” and thus can be much harsher than IRS auditors and appeals officers.

FTB Auditors & Appeals Officers are harsher and more unreasonable than their IRS counterparts

FTB Installment Agreement. If you owe the FTB more than you can pay, then an Installment Agreement similar to the IRS’ is available and, like the IRS Installment Agreement, it is by far the most common way to deal with paying state taxes. However, the FTB Installment Agreements are harder to qualify for and involve greater scrutiny of taxpayer finances. The FTB is also much more aggressive than the IRS in getting people into Installment Agreements. The FTB sends only one notice of Intent to Levy, shortly after it sends the Notice of Proposed Assessment. If it does not hear from the taxpayer within 2-4 weeks, the FTB begins levying accounts and garnishing wages. It really, really wants to be paid. Also, in order to qualify for an Installment Agreement, the FTB wants to see receipts for all categories of living expenses, down to grocery receipts. It requires far more documentation for Installment Agreements than the IRS does, and it generally allows less in basic monthly living expenses than the IRS does. So, while the application process appears simple (check out the on-line forms here), the acceptance is anything but simple. The FTB is also fickle about honoring its Installment Agreements. It ends them for the slightest issue. Finally, there is no Uncollectible Status with the FTB, where it leaves an insolvent taxpayer alone for a year before looking for payment again, the way the IRS does. If a taxpayer owes the FTB, she must make monthly payments of some amount, no matter how destitute, or how vanishingly small the business’ margins are.

California Department of Fee and Tax Administration (“CDTFA”)

FTB Offer-in-Compromise. An Offer-in-Compromise, in which some tax debt is forgiven, is hard to get from the IRS (read about it here). It is much harder to get from the FTB. A taxpayer needs to have no chance of future earning potential for the FTB to agree to writing off some of the tax. This means only the most critically and permanently disabled younger people, and the very elderly are accepted for OICs by the FTB. The application process, as outlined on the FTB’s website, seems straightforward and even encouraging. What the site doesn’t convey, however, are the behind-the-scenes landmines that result in most FTB Offer-in-Compromise applications being denied. That’s why having an experienced tax attorney help you can be so valuable.

If you owe the FTB more than you can full-pay, call me; getting Installment Agreements accepted is tricky

California Department of Fee and Tax Administration (“CDTFA”)

Sales & Other Taxes

The California Department of Tax and Fee Administration is primarily responsible for collecting the state’s sales tax. It was created in 2017, largely replacing the Board of Equalization (which is still the appeals unit for disputes with the CDTFA). As a result, only businesses and business owners have issues with the CDTFA. In addition to the state sales tax, the FTB oversees 30 other taxes and fees, from the jet fuel tax to the California tire fee. Check them out here.

The CDTFA is an audit-intensive agency. Unfortunately, there are no systematic or predictable audit CDTFA triggers. That’s unfortunate because dealing with the CDTFA is so frustrating and I wish I could tell clients what to do to avoid an CDTFA audit. The biggest problem with CDTFA audits is that the methods used by its auditors for calculating sales and use taxes tend to be bizarre, often never-seen-before “formulas”. Their process for calculating things such as mark-ups, profit margins and cost-of-goods-sold often are not the commonly accepted methods used by most bookkeepers and accountants. This means it’s frequently hard to understand how the CDTFA arrives at the amount of tax it says is “correct”, and thus difficult to successfully argue against its calculations. And, of course, like the IRS, the CDTFA has the full power of the California state government to enforce its decisions, which means the burden of proof for overturning a bad audit result is on the taxpayer. Moreover, CDTFA auditors are highly intransigent – they’ll dig their heels in on an unreasonable audit methodology or tax increase even more firmly than the FTB.

Making interactions with the CDTFA even more challenging is the skill level of many of its agents and auditors. Many (not all) CDTFA auditors are not well-trained, so getting them to explain their calculations, or understand how my client calculated the financial ratio at issue, can be maddeningly difficult. Perhaps lack of sufficient training to do their job competently is one reason CDTFA employees have the worst morale of any of the tax agencies I’ve dealt with. I’ve had a CDTFA auditor ask me for a job, with the insinuation that my client would get a better audit result if I came through. I’ve had some agents simply tell me not to call them anymore. This unprofessional, “Wild West” and quasi-corrupt environment is one reason for the 2017 reorganization of the former Board of Equalization into the CDTFA: if the old BOE audited you, it was well-known that the only way to get a good appeal result was to call and lobby the BOE representative on your case before the hearing. The CDTFA has cleaned up its act a bit, but I see traces of the old BOE in the current CDTFA’s sloppy methods, insufficient staff training, and subpar employee morale.

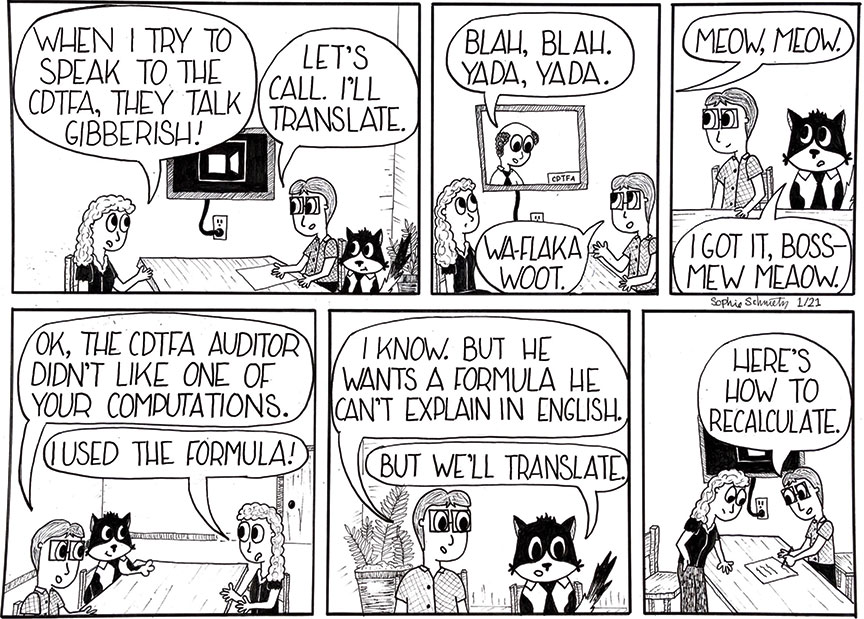

So how can a business successfully appeal a bad CDTFA audit result? In my experience, the only consistently winning approach is to politely and persistently question and quiz the auditor on their formula/method until I understand it well enough that I can replicate it and then explain it to my client or their accountant (who tend to have no idea how the CDTFA arrived at their assessment because of the CDTFA’s frequent non-standard ways of calculating business figures such as cost-of-goods sold). Once my client also understands what the auditor did, we can determine how the client’s data and accounting processes can be turned into an alternative the auditor may find acceptable. I liken my job to that of a translator: I decode what the auditor has done, explain it to the business owner, gather what the auditor needs from the client, and take it back to the auditor in a language s/he is likely to understand and agree with. Fortunately, I love languages (I’m fluent in two languages and proficient in two others – read about it here, if you’re interested). And spreadsheets and math. Tell me about what’s going on with your CDTFA issue, so I can give you my best assessment of whether fighting the CDTFA is worth it and, if so, how to effectively do so.

Prevailing against the CDTFA isn’t for the faint-hearted: there’s the frustration of dealing with a vexing bureaucracy and the challenge of deciphering an audit result that is usually a big mystery

Employment Development Division (“EDD”)

Unemployment & Disability Payroll Taxes

California’s Employment Development Division collects the state’s payroll taxes which consist of disability (SDI), employment training and unemployment taxes (UI). Business owners are most frequently the target of EDD actions, while self-employed individuals occasionally are, if they have failed to file their SDI and UI taxes. Failure to full-pay payroll taxes can be deadly for a business owner. The EDD (and the IRS with respect to Social Security and Medicare payroll taxes) considers the failure by business owners to remit payroll taxes withheld from their employees’ pay theft from the employee – an unindicted crime. As a result, the EDD can enforce collections so strictly that it can and will shut down a business. Since the EDD has such a strong pro-labor, anti-business bias, most business owners want someone who’s on their side when dealing with the agency.

In my experience, the EDD is the nastiest of the tax agencies to deal with, for several reasons. First and most importantly, the California legislature believes all power in the employer-employee relationship resides on the employer side. Thus, the legislature, and the EDD by extension (since it gets its mandate from the legislature), assume that businesses are wealthy and dishonest, capable of funding the state’s unemployment and disability insurance but likely to be cheating on what they owe. Reading the EDD website won’t give you direct evidence of this bias, but it’s blindingly obvious when interacting with EDD agents.

You want to avoid interaction with the EDD, so hire an excellent payroll service and always remit California payroll taxes on-time

The second reason the EDD is my least favorite tax agency is that it is the murkiest, least transparent bureaucracy of the four tax agencies I interact with. While the hierarchy is apparent, who within the hierarchy actually has authority to make decisions on specific matters is non-obvious and changes regularly. Third, the EDD is the tax agency most likely to shut down a business if they can’t full-pay owed payroll taxes. Why? The EDD doesn’t care if closing the business ruins the owner’s ability to pay what’s owed – they want the theft of payroll taxes to stop. Moreover, most EDD agents don’t actually believe putting severe pressure on business owners will result in closure – they think businesses are extremely powerful and will find ways to stay open. Relatedly, the EDD rarely agrees to Installment Agreements longer than 18 months, even if more than $100,000 is owed. So how can a business owner deal with such a nasty agency? In my experience, the only way to prevail against the EDD is comply with the law, and then lean on the law when disputing EDD assessments. In short, call me.