Since the fall, I have seen a big uptick in desperate people calling me for tax or bankruptcy help. What kind of desperation? These people have been either on the IRS’s radar, or been having debt problems, for many years and then the crisis hits: the IRS puts a lien on a house, or a creditor gets a default judgment and the sheriff Read more »

September 23, 2021

Author: John Faucher

Discharging Tax Debt in Bankruptcy

It’s possible to discharge (have tax debt wiped out) most federal taxes in bankruptcy. There are exceptions, however. Many of the times when taxes aren’t dischargeable in bankruptcy are very straightforward, but one is open to interpretation and thus quite murky. Read more »

September 13, 2021

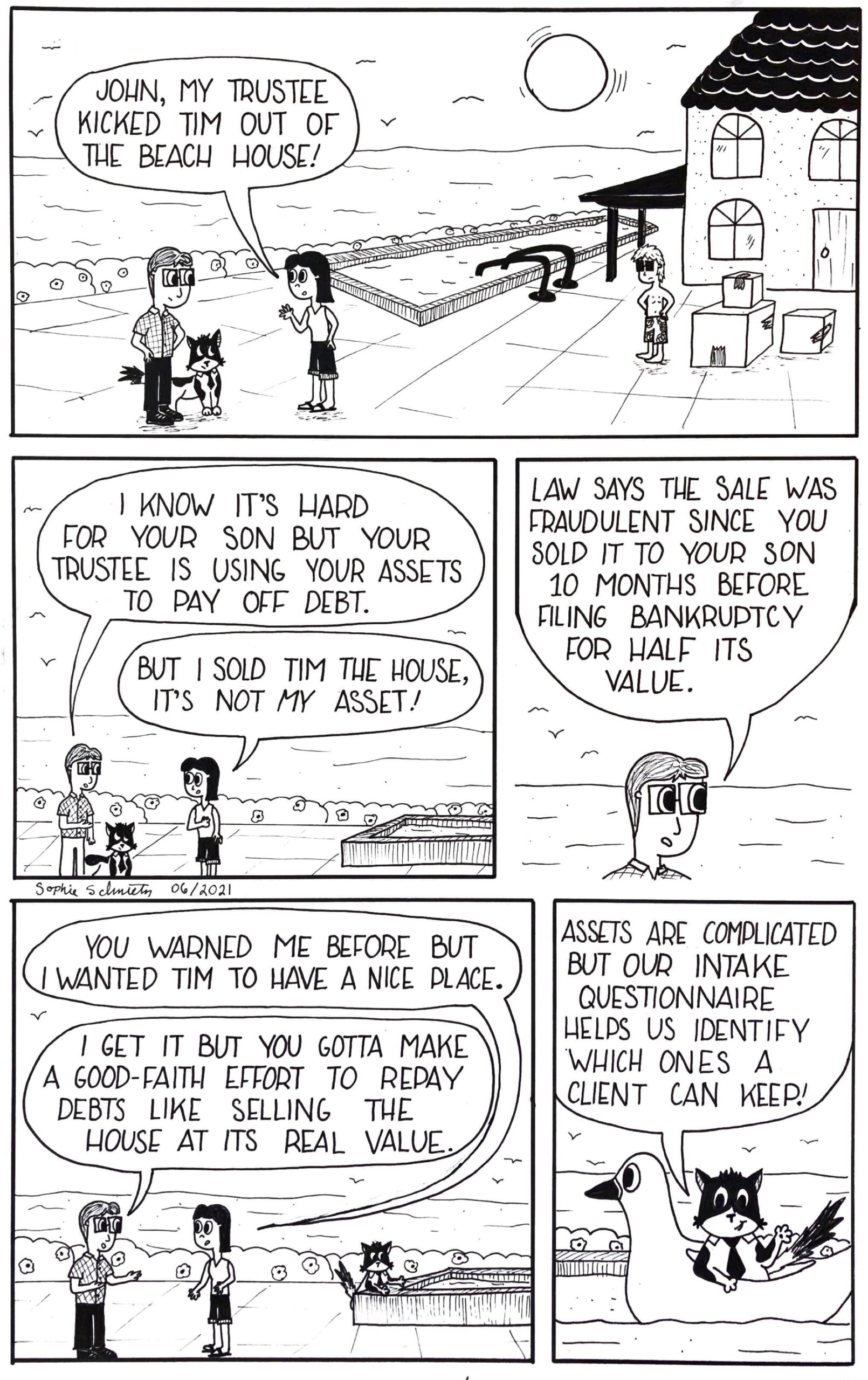

Sebastian Explains Why Selling Property for Less Than Market Value Before Bankruptcy is A No-No

If a debtor sells property for less than full market value before filing bankruptcy, the law considers this a form of theft from the bankruptcy estate: the Bankruptcy Trustee could have sold it for more money to pay off the debtor’s creditors. But, sometimes Sebastian the Feline Paralegal’s explanations are more fun to read. Read more »

September 3, 2021

The Bankruptcy Trustee

When you file a a chapter 7 bankruptcy, everything you own and owe is legally transferred to a Bankruptcy Trustee, who can then use your assets to pay your debts. Read more »

August 26, 2021

When Can You DIY an IRS Offer In Compromise?

The IRS and the FTB don’t negotiate tax debt. Neither agency will write off a dime of tax debt because the taxpayer asks it to. Their missions are to collect taxes owed equally from taxpayer, and to inflict financial pain to do so because there can’t be favoritism in collecting taxes owed. Read more »

August 17, 2021

Tax Protesters Sail on Seas of Fantasy

Is it true that there is no law requiring payment of income tax? After all, many tax protesters assert this. And, in my 10 years as an attorney for the IRS, I came across several particularly colorful protesters, including one who attempted to evade taxes by claiming he was a ship. Seriously. Read more »

August 11, 2021

Got Bad Info From an IRS Agent? Too Bad…the Law Assumes They’re Incompetent. Seriously.

A client spoke IRS with an IRS revenue officer about his payroll tax issue (before he found me). The revenue officer said not to worry about it, that my client’s matter wasn’t a high priority, and that they thus had time to work things out. But two weeks later the IRS levied on his payroll account, despite what the revenue officer said. Read more »

July 29, 2021

Considering Bankruptcy? Tip 7 – Get Out of Denial

There’s an almost rapturous feeling that my bankruptcy clients feel when they hear “discharged” about their debts in a Chapter 7 bankruptcy case. Read more »

July 21, 2021

How to Buy from A Bankruptcy Estate

Ninety-nine percent of bankruptcies are “no-asset” cases. The Trustee talks to the debtor, looks at their schedules, and determines that the debtor truly has nothing worth selling. Read more »

July 16, 2021

Minor Child’s Account with Parent Social Security # – A Cautionary Tale

Here’s a story, with lessons, of how putting your social security number on a minor child’s account can go wrong. Read more »

July 6, 2021