I don’t take credit cards. I don’t think it’s ethical, and here’s why Read more »

Bankruptcy Procedure

How the DOJ Can Mess Up Getting Rid of Tax Debt in Bankruptcy

Tax debt is dischargeable in bankruptcy. However, unlike many other nondischargeable debts (fraud, malicious tort, etc.), tax debt may actually remain in force with no further word from the court. Huh? The IRS or the FTB could come back five years after the discharge and start collecting on taxes Read more »

What Happens at a Bankruptcy 341 Meeting of Creditors?

In chapter 7 bankruptcy, everything you own and owe is briefly transferred to a bankruptcy Trustee, who can then use your assets to pay your debts. If you have more debts than assets, then those debts are “discharged” or wiped out (there are exceptions for some debts… Read more »

Hard Truths for Debtors Who Procrastinate

Since the fall, I have seen a big uptick in desperate people calling me for tax or bankruptcy help. What kind of desperation? These people have been either on the IRS’s radar, or been having debt problems, for many years and then the crisis hits: the IRS puts a lien on a house, or a creditor gets a default judgment and the sheriff Read more »

Discharging Tax Debt in Bankruptcy

It’s possible to discharge (have tax debt wiped out) most federal taxes in bankruptcy. There are exceptions, however. Many of the times when taxes aren’t dischargeable in bankruptcy are very Read more »

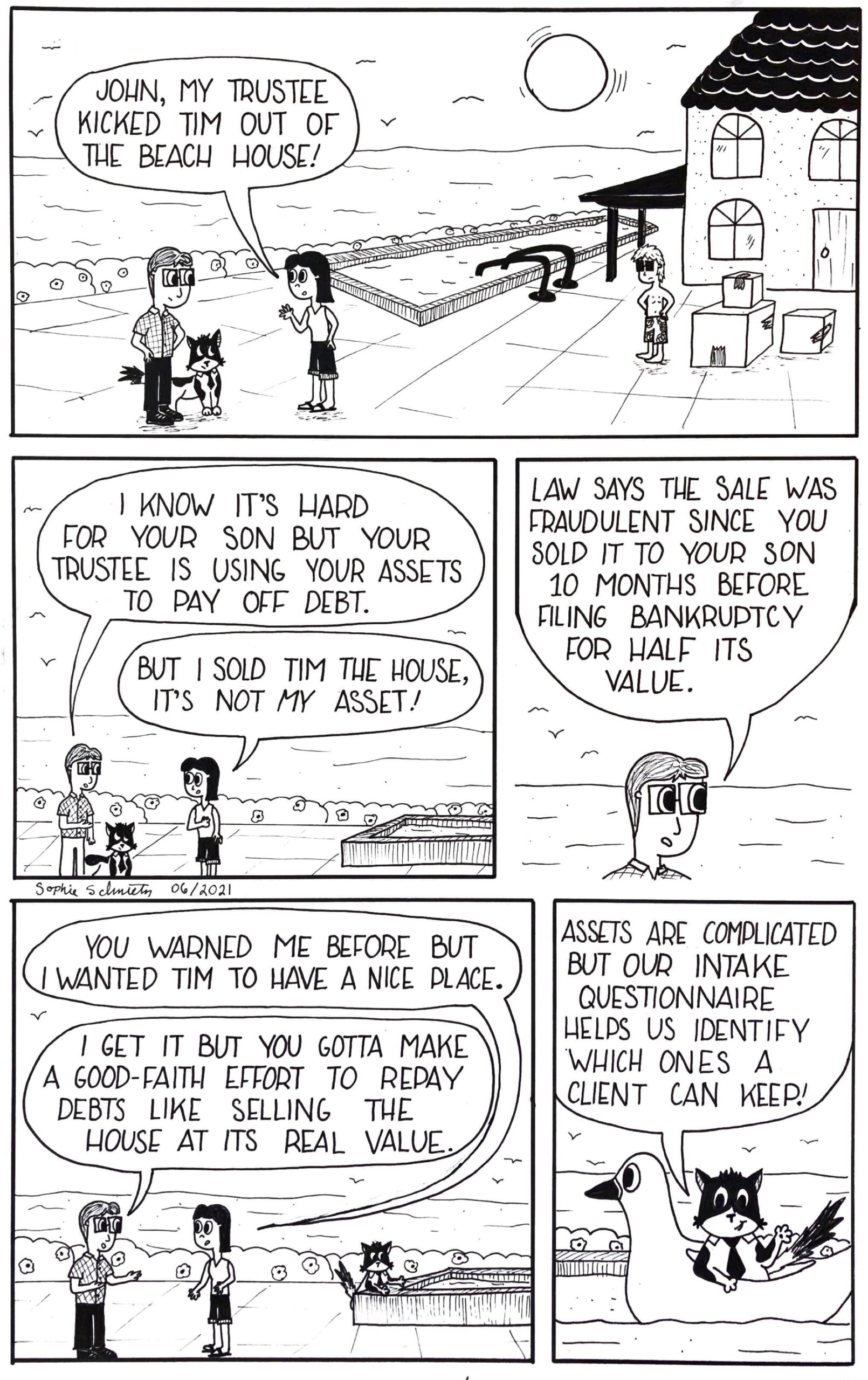

Sebastian Explains Why Selling Property for Less Than Market Value Before Bankruptcy is A No-No

If a debtor sells property for less than full market value before filing bankruptcy, the law considers this a form of theft from the bankruptcy estate: the Bankruptcy Trustee could have sold it for more money to pay off the debtor’s creditors. But, sometimes Sebastian the Feline Paralegal’s explanations are more fun to read.

The Bankruptcy Trustee

Trustee in Chapter 7 Bankruptcy When you file a a chapter 7 bankruptcy, everything you own and owe is legally transferred to a Bankruptcy Trustee, who can then use your Read more »

How to Buy from A Bankruptcy Estate

Ninety-nine percent of bankruptcies are “no-asset” cases. The Trustee talks to the debtor, looks at their schedules, and determines that the debtor truly has nothing worth selling. Read here for more Read more »

Considering Bankruptcy? Tip 5 – Timing Matters

Timing matters in bankruptcy. For example, if you have seasonal fluctuations in income (like teachers and realtors), then at some times of year your income may be too high to qualify Read more »

How Inheritance Impacts Bankruptcy

It’s horrible to have a loved one die. But sometimes the death comes with a silver lining in the form of an inheritance. However, for someone with lots of debt Read more »