Congress granted the IRS the power to revoke passports in December 2015. Under this law, if you owe more than $51,000 to the IRS, then you could lose your passport. Read more »

June 9, 2021

Taxes

The IRS Can (Almost) NEVER Waive Interest on Late Taxes

A business-owner client recently claimed an R&D tax credit available to him. The IRS denied his use of the credit, he hired me, we went to Tax Court and ultimately won most of the issues. My client wound up owing something, just much less than what the IRS originally asserted. That made my client happy. Read more »

May 26, 2021

Considering Bankruptcy? Tip 5 – Timing Matters

Timing matters in bankruptcy. For example, if you have seasonal fluctuations in income (like teachers and realtors), then at some times of year your income may be too high to qualify for bankruptcy. But, if you wait a few months, your low-season income may qualify you. Read more »

May 20, 2021

Considering Bankruptcy? Tip 4 – Good for Tax Debt But Not Student Loan Debt

Bankruptcy Will Allow You to Get Rid of Most State & Federal Income Tax Debt. In fact, this why I practice tax and bankruptcy law – because bankruptcy can be used in some cases to get rid of tax debt. Read more »

May 7, 2021

Tales From the Tax Troll Trenches: IRS Says Don’t Use US Mail

As readers of my Newsletter and Blog know, dealing with the IRS daily means I uncover unreasonable policies and bizarre agents at the IRS on a regular basis (and don’t even get me started on the policies and personnel of the California Tax agencies, who make the IRS seem highly efficient and professional). Read more >>

April 12, 2021

Installment Agreement for Tax Debt: Much Harder To Set Up with California’s FTB than the IRS

My website outlines the many ways in which the California tax agencies (Franchise Tax Board, CA Department of Tax & Fee Administration, Employment Development Division) are FAR harder to deal with, and aggressive in their tax collection attempts, than the IRS. Read more >>

April 13, 2021

Problems with the IRS? Who are you gonna call?

Katie Clunen is a terrific family law attorney in Westlake Village. Tax issues often arise when couples divorce, so Katie and I often need to speak. Read more >>

March 5, 2021

Tax Issues in Divorce: Who Represents Who?

Katie Clunen is a sharp family law attorney in Westlake Village, CA. She recently asked me whether a couple with tax issues going through a divorce need separate attorneys to deal with the tax problem, or whether they can jointly hire a tax attorney. Watch this short Vlog for the answer. Read more >>

February 12, 2021

Why I Practice Tax Law

My life left the path of “average” when my father, a research chemist, received a posting in his company’s sales division in Geneva, Switzerland. Read more >>

February 10, 2021

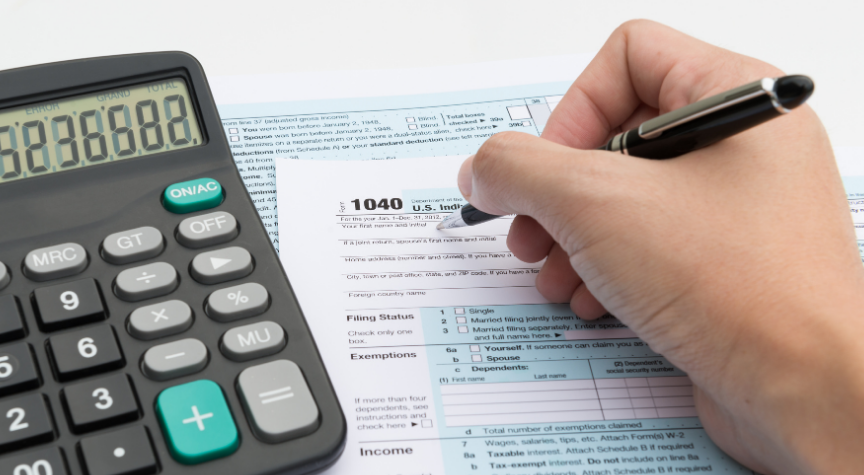

Filing a Tax Return and Audit Selection

That dreaded, fifth season of the year is soon to be upon us: Tax Season. Many Americans are turning their attention to tax returns and as they file, most people wonder “could I get audited this year?” The statistical chances of a tax return getting flagged for an audit are very small, but it still weighs on one’s mind. So, let’s take a look at the filing and audit process a little closer: Read more >>

January 28, 2021