Readers of my blog know I frequently berate Congress for having cut the IRS’ budget while dramatically increasing its workload in the past decade. But here’s the politically conservative Wall Street Journal, letting us know how the IRS’s woes are encouraging tax evasion. Read more »

March 8, 2022

Tax Collection Issues

2021 Was Horrible for IRS Responsiveness: 2022 Will Be Worse

The IRS’s 2021 responsiveness has been rightfully panned. Due to budget constraints, Covid work restrictions for IRS employees, and a huge work increase from administering much of the Economic Recovery Act, the IRS was pounded and thus taxpayers were, too. But, if last year was bad, this year will be worse Read more »

February 24, 2022

Why IRS Doesn’t Negotiate Payroll Tax Debt – EVER

Business owners with payroll tax debt often ask me why the IRS won’t lift its levy or lien. After all, these clients argue, I just need a bit of free cash to invest back into my business, to make the money to pay what I owe. If the IRS cripples my business with liens or levies, then I can’t make the money to repay them. So, why doesn’t the IRS act more like my business partner, let me continue to operate, and make the money to pay them back Read more »

November 16, 2021

Hard Truths for Debtors Who Procrastinate

Since the fall, I have seen a big uptick in desperate people calling me for tax or bankruptcy help. What kind of desperation? These people have been either on the IRS’s radar, or been having debt problems, for many years and then the crisis hits: the IRS puts a lien on a house, or a creditor gets a default judgment and the sheriff Read more »

September 23, 2021

IRS’ Right to Take Your Passport

Congress granted the IRS the power to revoke passports in December 2015. Under this law, if you owe more than $51,000 to the IRS, then you could lose your passport. Read more »

June 9, 2021

The IRS Can (Almost) NEVER Waive Interest on Late Taxes

A business-owner client recently claimed an R&D tax credit available to him. The IRS denied his use of the credit, he hired me, we went to Tax Court and ultimately won most of the issues. My client wound up owing something, just much less than what the IRS originally asserted. That made my client happy. Read more »

May 26, 2021

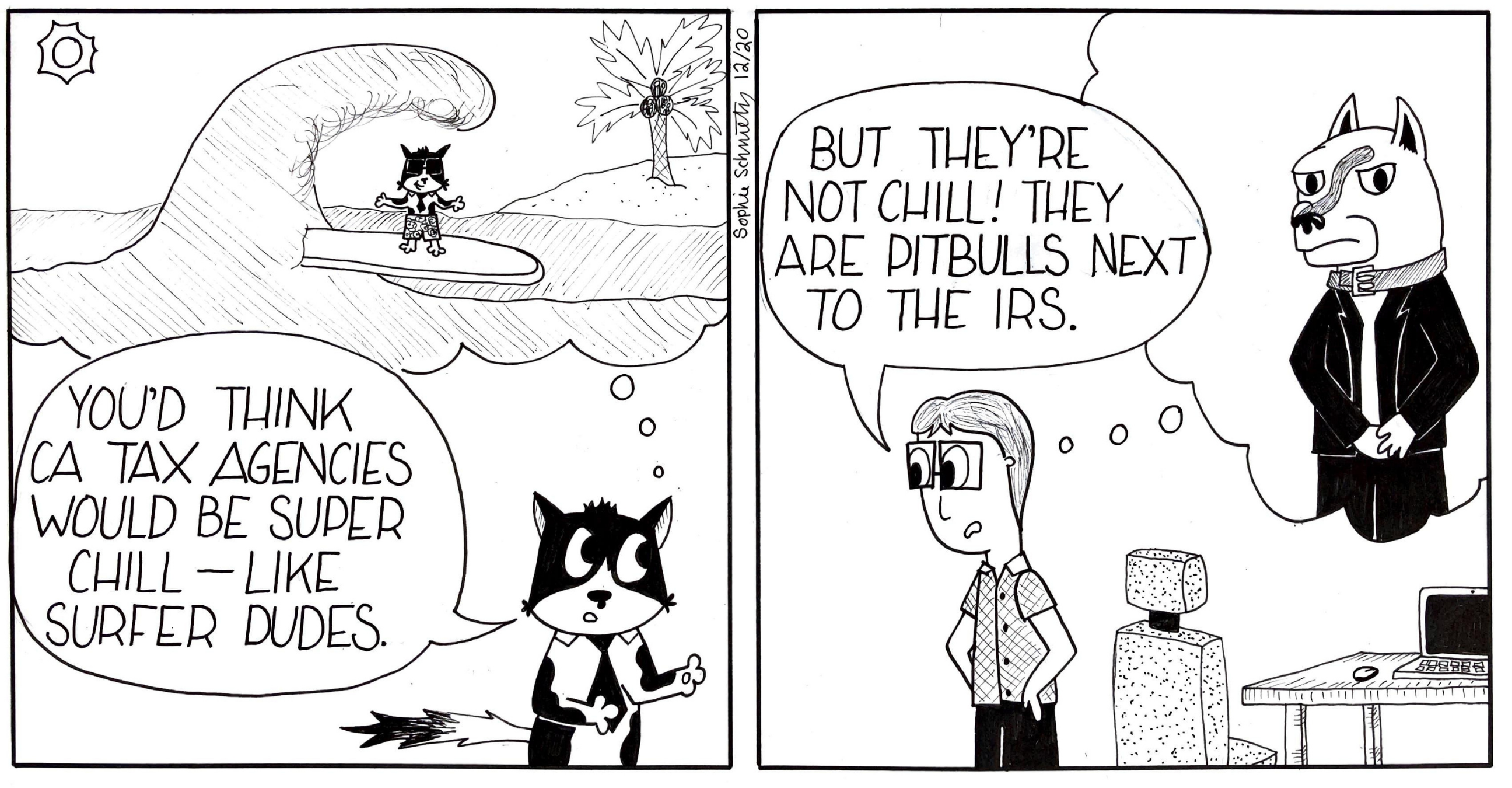

Tales From the Tax Troll Trenches: IRS Says Don’t Use US Mail

As readers of my Newsletter and Blog know, dealing with the IRS daily means I uncover unreasonable policies and bizarre agents at the IRS on a regular basis (and don’t even get me started on the policies and personnel of the California Tax agencies, who make the IRS seem highly efficient and professional). Read more >>

April 12, 2021

Installment Agreement for Tax Debt: Much Harder To Set Up with California’s FTB than the IRS

My website outlines the many ways in which the California tax agencies (Franchise Tax Board, CA Department of Tax & Fee Administration, Employment Development Division) are FAR harder to deal with, and aggressive in their tax collection attempts, than the IRS. Read more >>

April 13, 2021

Problems with the IRS? Who are you gonna call?

Katie Clunen is a terrific family law attorney in Westlake Village. Tax issues often arise when couples divorce, so Katie and I often need to speak. Read more >>

March 5, 2021

The IRS and its Notice of Federal Tax Lien

When a taxpayer doesn’t pay income taxes, the IRS automatically gets a lien against the taxpayer’s property. That means that legally, the taxpayer can’t sell anything without using the proceeds to pay the IRS. The IRS almost never enforces this “silent lien,” however. It’s silent because no one else knows about it. Read more »

June 22, 2020