A client spoke IRS with an IRS revenue officer about his payroll tax issue (before he found me). The revenue officer said not to worry about it, that my client’s matter wasn’t a high priority, and that they thus had time to work things out. But two weeks later the IRS levied on his payroll account, despite what the revenue officer said. Read more »

July 29, 2021

Blog

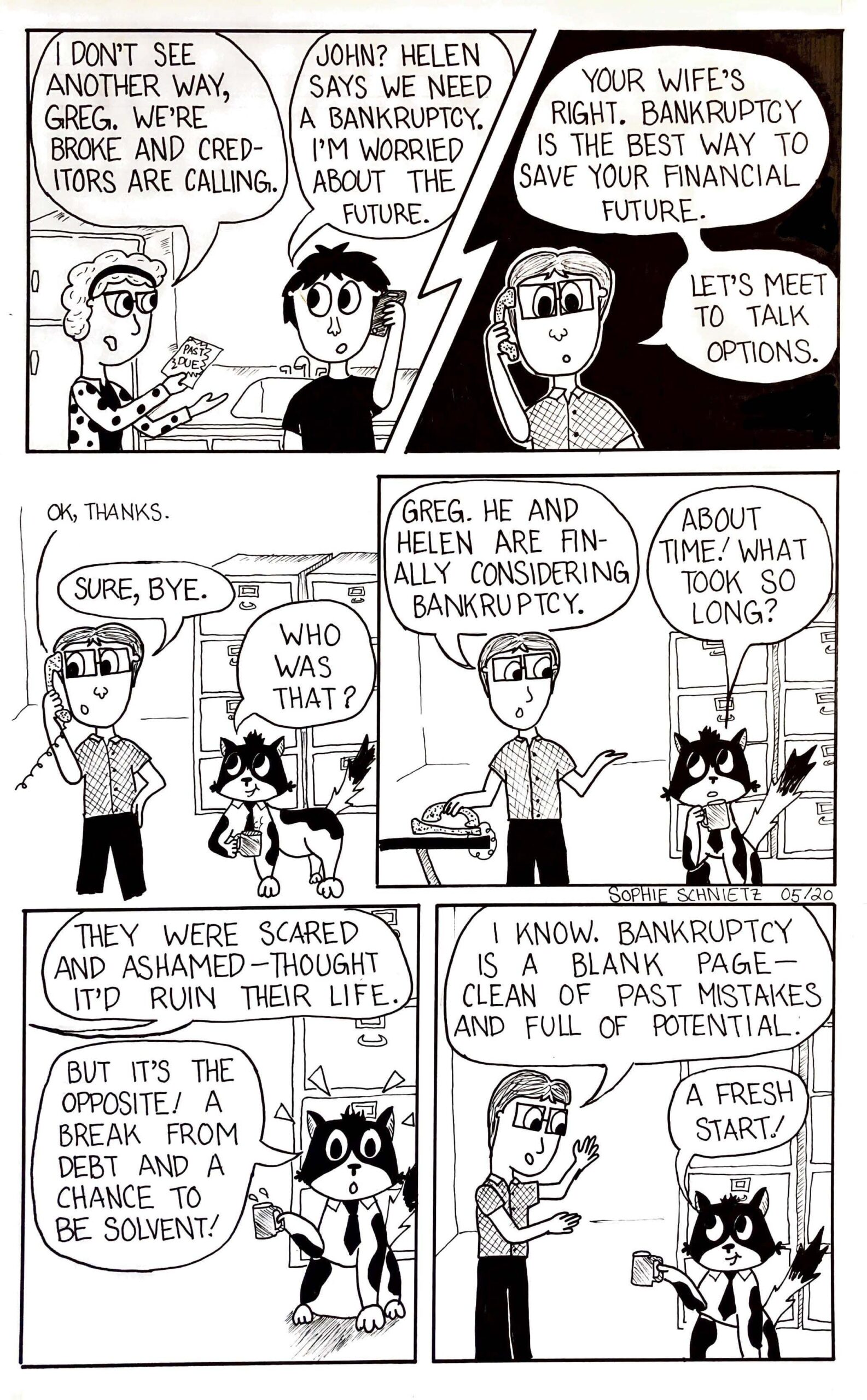

Considering Bankruptcy? Tip 7 – Get Out of Denial

There’s an almost rapturous feeling that my bankruptcy clients feel when they hear “discharged” about their debts in a Chapter 7 bankruptcy case. Read more »

July 21, 2021

How to Buy from A Bankruptcy Estate

Ninety-nine percent of bankruptcies are “no-asset” cases. The Trustee talks to the debtor, looks at their schedules, and determines that the debtor truly has nothing worth selling. Read more »

July 16, 2021

Minor Child’s Account with Parent Social Security # – A Cautionary Tale

Here’s a story, with lessons, of how putting your social security number on a minor child’s account can go wrong. Read more »

July 6, 2021

Sebastian On Why Bankruptcy Is One of The Best Things You’ll Do

Many of my clients are embarrassed to be considering bankruptcy. I get it. But there’s a huge upside to bankruptcy. Don’t trust me? Why not see what Sebastian, my Feline Paralegal, has to say Read more »

June 29, 2021

Cheerleading Biden’s Increased IRS Budget Proposal

I enthusiastically applaud President Biden’s proposal to increase the IRS’s budget by $1.2 billion, or more than 10 percent over this year’s budget. In fact, call me a huge cheerleader for this proposal. Read more »

June 24, 2021

Tax Debt Non-Dischargeable in Bankruptcy, Except When…

Debtors can discharge their taxes in bankruptcy so long as they meet certain tests: the three-year test, the two-year test, the 240-day test and no fraud. I lay it out here. Read more »

June 17, 2021

IRS’ Right to Take Your Passport

Congress granted the IRS the power to revoke passports in December 2015. Under this law, if you owe more than $51,000 to the IRS, then you could lose your passport. Read more »

June 9, 2021

Considering Bankruptcy? Tip 6 – Don’t Feel Ashamed

Many clients feel shame about filing for bankruptcy protection. I can tell because they tell me repeatedly that they never thought they would be talking to a lawyer about bankruptcy, or that they fully intended to and still intend to pay their debts. Read more »

June 1, 2021

The IRS Can (Almost) NEVER Waive Interest on Late Taxes

A business-owner client recently claimed an R&D tax credit available to him. The IRS denied his use of the credit, he hired me, we went to Tax Court and ultimately won most of the issues. My client wound up owing something, just much less than what the IRS originally asserted. That made my client happy. Read more »

May 26, 2021