The IRS’s 2021 responsiveness has been rightfully panned. Due to budget constraints, Covid work restrictions for IRS employees, and a huge work increase from administering much of the Economic Recovery Act, the IRS was pounded and thus taxpayers were, too. But, if last year was bad, this year will be worse Read more »

February 24, 2022

Author: John Faucher

Faucher Family Farms Update

Readers of my blog and newsletter know I have a side-gig in about a dozen hens. I love them and I love the fresh eggs they give me. That’s me with one of the girls. I’ve written about my flock before. Notice the nifty Faucher Family Farms shirt Karen got me for Christmas. Read more »

February 14, 2022

Tales From the Tax Troll Trenches: 3 Years to Assign Revenue Officer

Readers of my blog know I like to unload on the IRS occasionally. Here’s another story from the Tax Troll Trenches Read more »

January 21, 2022

What Happens to Tax Liens In Bankruptcy?

Debtor’s often have Notice of Federal Tax Lien outstanding at the time they file bankruptcy. How are these handled? Broadly, a properly-noticed lien survives bankruptcy. It continues to attach to any property Read more »

January 11, 2022

Why Bankruptcy Attorneys Shouldn’t Accept Credit Cards

I don’t take credit cards. I don’t think it’s ethical, and here’s why Read more »

December 29, 2021

How Bankruptcy Attorneys Can Stop Unethical Debt Collectors

In the cat-and-mouse game between debtors and creditors, it’s no surprise that there are dishonest debt collectors. Many of my bankruptcy clients are well-acquainted with debt collectors, often having been harassed by them for years before coming to me. Among the illegal collection practices these collection firms employ Read more »

December 21, 2021

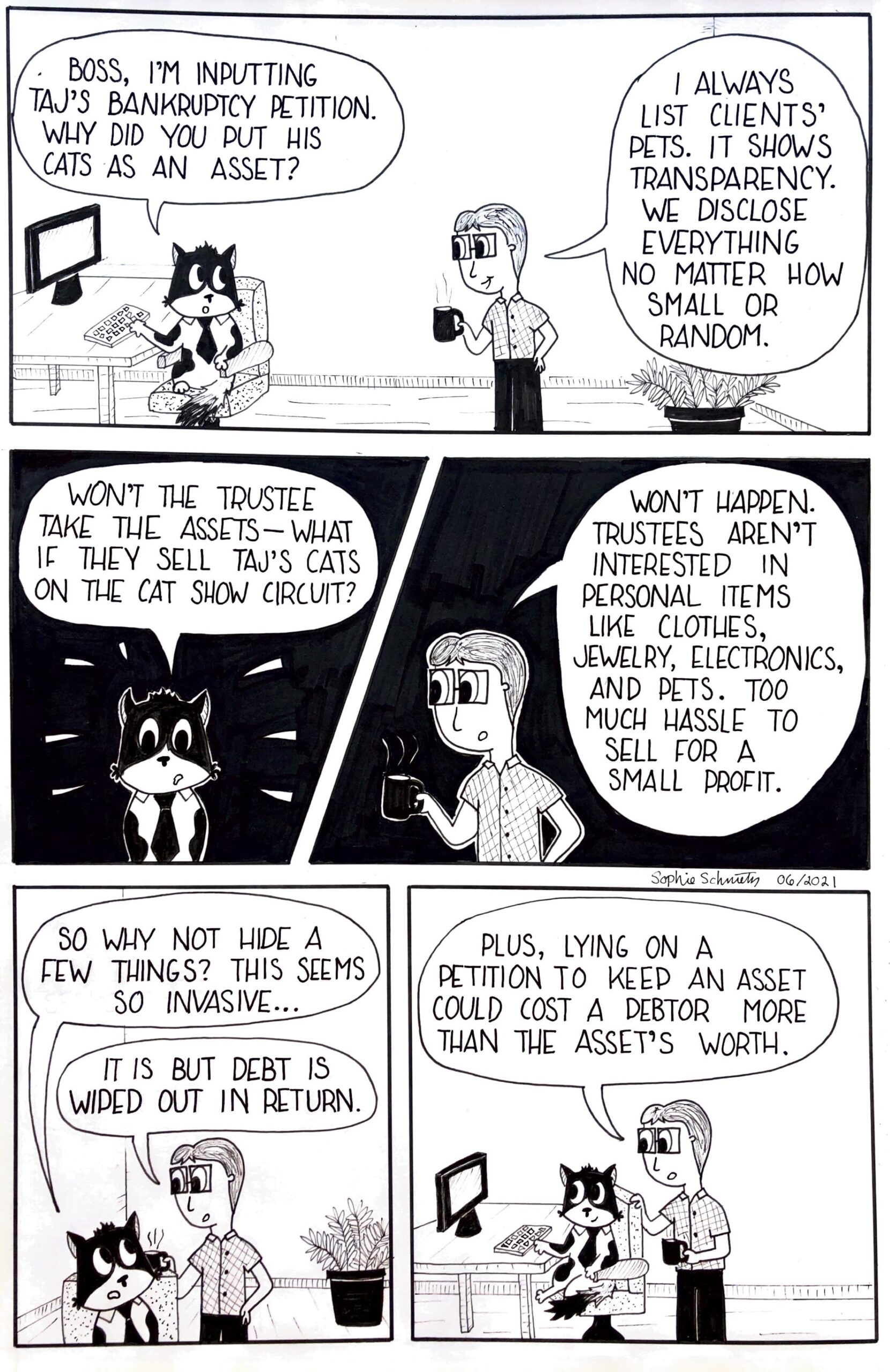

Sebastian Explains Why Disclosing All Assets is Key to a Positive Bankruptcy Outcome

Sometimes my clients don’t believe me when I tell them they must disclose all their assets when going through Chapter 7 bankruptcy (or any other bankruptcy). With that in mind, maybe Sebastian, my Feline Paralegal, can explain things a bit better Read more »

December 10, 2021

Why You Should Give IRS As Much Documentation As Possible

There are hundreds of strategies for handling IRS issues. But not all strategies are as effective as others.

A car-repair owner got audited and brought his tax-return preparer (Jim) to handle the audit. The preparer said to give the IRS as little information as possible . “The IRS won’t want to go to trial, and they’ll cave in at the last minute,” he said. But something didn’t seem right Read more »

December 1, 2021

Why I’m “Only” Assertive and Not Antagonistic

Here’s something I discuss on the landing page of my website, because I think it’s that important: I’m assertive but not antagonistic. Okay. So what? Some clients are so angry with the IRS they want to use me primarily for revenge, even if their case would have a better outcome if we approached the adversary calmly Read more »

October 13, 2021

The Statute of Limitations on IRS & FTB Tax Debt Collection

A potential client called me last week for help in dealing with the IRS. He owes taxes for 1992 to 1996. Had he filed the returns on time? Yes. Had he filed bankruptcy in the meantime? No. Had he filed an offer in compromise? No. Has he heard anything from the IRS in the last three years? No, but he thought that was because he had moved Read more »

October 4, 2021