I recently got a letter from Pioneer Credit Recovery of Horseheads, New York (population 6,461), telling me that it was taking over one of my clients’ accounts from the IRS. Read more »

November 13, 2020

Taxes

Reynolds & Reynolds CEO Charged With Hiding $2 Billion from IRS – Biggest U.S. Tax Evasion Ever

I saw this article originally in the Wall Street Journal, front page. But, I’m posting from the New York Times, because it’s not behind a paywall. Read more »

October 16, 2020

IRS Audit Challenge – Tax Bill of $203,000 Owed Reduced to $1,500 for Santa Barbara County Wine Merchant

A merchant who buys and sells wines through an LLC that shows up as a Schedule C business on his personal tax return was recently audited. Read more »

October 16, 2020

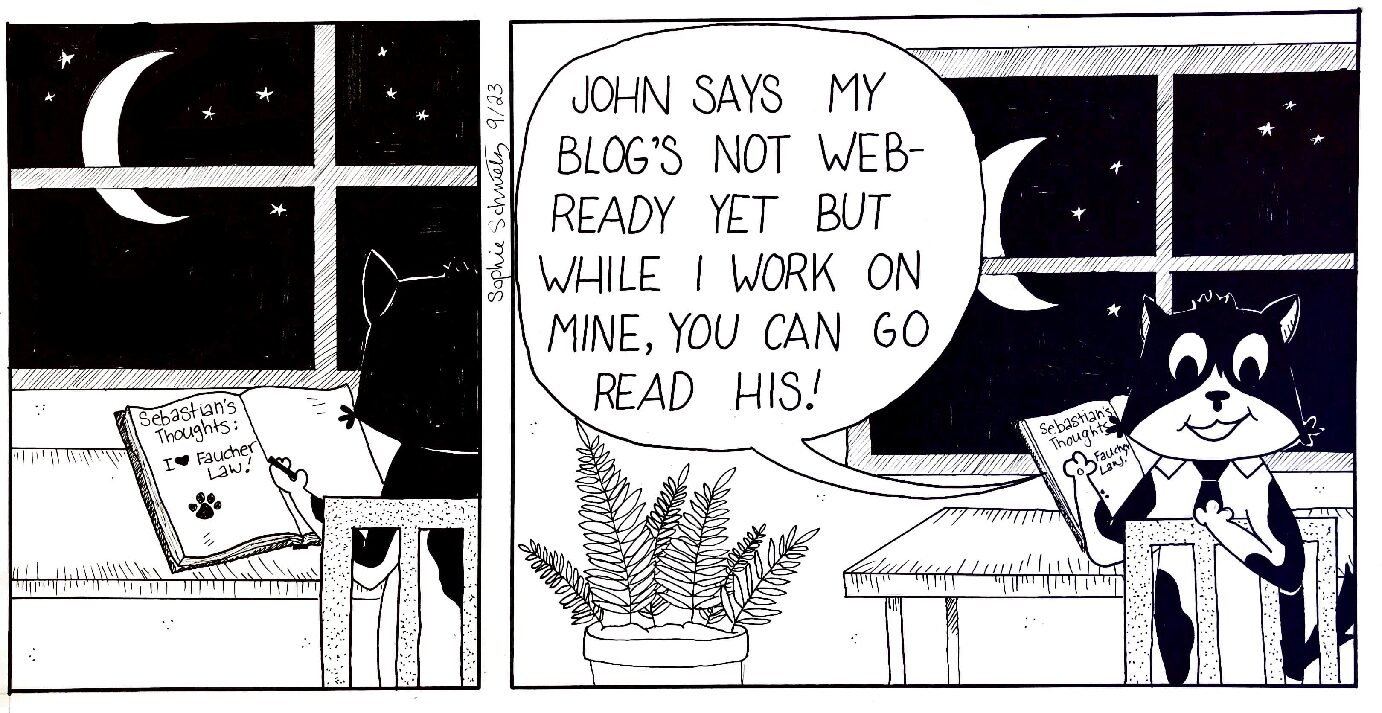

Sebastian the Paralegal Recommends John’s Tax and Bankruptcy Law Blog

Hi, Sebastian the Feline Paralegal here. “The boss” John, tax and bankruptcy lawyer, says

my blog’s not web-ready yet, which I think is ridiculous…see my tired paws??? Read more »

September 29, 2020

Which Tax Authorities Touch Californians?

The U.S. federal and California state governments fund their activities by imposing and collecting taxes on various transactions. Read more »

September 22, 2020

IRS Mail Backlog, and US Government

Like so many businesses, the IRS shut down most of its operations during the early months of the pandemic, returning to full work only in early July. Read more »

September 4, 2020

Can You Negotiate Away An IRS Tax Lien?

A tax lien is a relatively passive way for the IRS or California’s Franchise Tax Board to get paid the back taxes you owe. Why passive? Because it can take a long time for the IRS or FTB to get paid. Suppose there’s a lot of equity in your house and owe you the IRS: when the IRS files a notice of tax lien against your house, nothing changes immediately. Read more »

June 15, 2020

Getting Rid of Tax Debt with Bankruptcy Can Take Time – Lots of It

Clients often arrive in my office, panicking, with big problems such as unpaid student loans, huge tax or business debts, and creditors filing liens. They want their problems to go away immediately – rightly so because the stress is terrible. But, for many clients, the only effective strategy is one that will take time. Often lots of it. Read more »

May 6, 2020

IRS Account Transcript: What the IRS Knows About You

Everything the IRS knows about you exists on a piece of paper called the Account Transcript. I get a client’s transcript when I begin representing them because I need to know what the IRS knows about Read more >>

January 17, 2020

Things to Dislike About California’s EDD: No One Agent Is In Charge

California’s Employment Development Department (EDD) collects and administers California’s State payroll taxes (consisting of the state income, disability, employment training Read more >>

November 29, 2019