When the IRS does not have enough people to answer questions, perform audits, or collect the taxes, several things happen. The US Treasury doesn’t collect as much tax revenue as it should. Some people start evading taxes, figuring they can get away with it. Read more »

September 13, 2019

Blog

Which Possessions Will I Lose in Bankruptcy?

Clients often ask whether they can keep a treasured possession, like a 1968 Camaro, out of their bankruptcy? Technically, no. What Can I Keep? When filing bankruptcy, Read more >>

September 6, 2019

When Is An Offer In Compromise Advisable?

I don’t like offers in compromise as a way to get rid of tax debt. The process is cumbersome, expensive, and arbitrary. There are better ways to deal with tax debt. Read more >>

August 28, 2019

Huge Foreclosure in Los Angeles

Being ultra-rich doesn’t insulate you from the bottom-feeding world of foreclosure and bankruptcy. Just ask Suzan Hughes, the widow of Herbalife’s founder, Mark Hughes. Read more >>

August 23, 2019

California FTB’s over-reaching definition of “doing business in California”

If it even brushes against California, the state government wants to tax it… Read more >>

August 15, 2019

Tax Liens versus Levies

What’s a tax lien? A tax levy? The short answer: it’s how the IRS forces non-taxpayers to become taxpayers. What’s the difference between them? Read more >>

August 6, 2019

Asset Protection Gone Horribly Wrong

“Asset Protection” means taking steps to keep people who are suing you for money owed, from taking your money or house. I had a house-flipper client who successfully protected a house a while ago, only to have the IRS come after it recently. Read more >>

July 30, 2019

How To Respond To An IRS Notice

A recent client walked in with 15 unopened envelopes from the IRS. Even though he’d been collecting the notices for a year, he only sought help when the IRS levied on one of his bank accounts. Read more >>

April 8, 2019

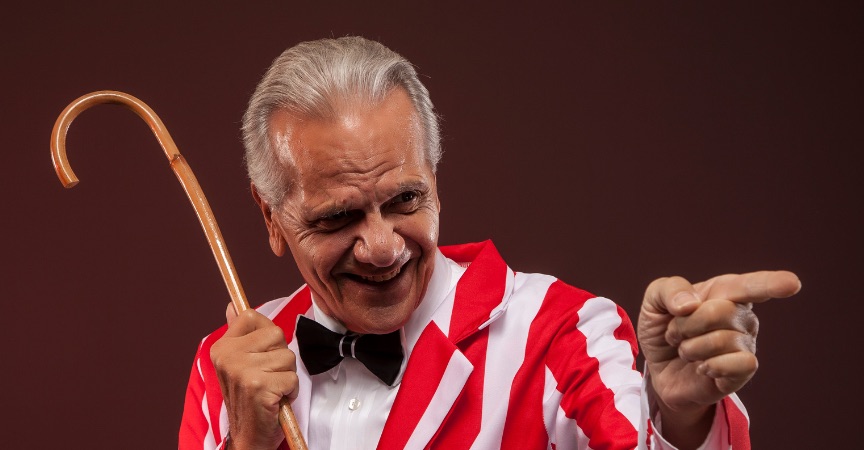

Beware Ads Promising To Get Rid Of IRS Tax Debt

“We Can Lower Your Tax Debt by 50, 70 Even 90 Percent!!!”

Ads like this are highly misleading. I have many clients who go first to the hucksters pedaling such false promises, and then come to me when it’s clear they won’t get anything for the money they paid these creeps. Read more >>

Chapter 12 Bankruptcy & Judicial Foreclosure

An investor was trying to collect on a note, and called me to help him out: he and a bunch of strangers had loaned $600,000 to a fellow living in the outskirts of Cambria, California. The fellow Read more >>

February 25, 2019