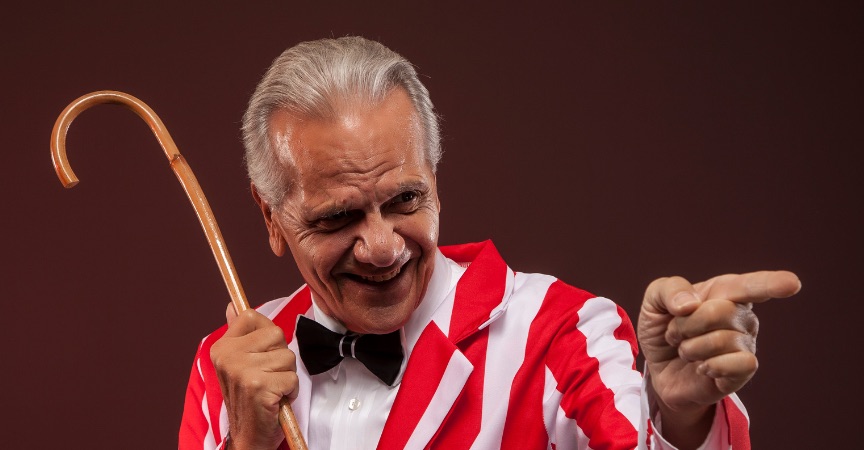

“We Can Lower Your Tax Debt by 50, 70 Even 90 Percent!!!”

Ads like this are highly misleading. I have many clients who go first to the hucksters pedaling such false promises, and then come to me when it’s clear they won’t get anything for the money they paid these creeps.

IRS Doesn’t Negotiate

While it is possible to negotiate your tax debt with the IRS, it is also extremely rare that the IRS will do so. Almost everyone who successfully negotiates away some of their tax debt will never work again and thus has no future earning potential. If you are among the millions of Americans who owe the IRS and are still working (or could be), there are ways to get a break from the IRS but these breaks are not negotiations. Why?

The IRS will never negotiate with a taxpayer because it doesn’t have to. Assessing and collecting taxes is a traditional, even iconic, exercise of governmental power. It does so without your consent. As an individual, you have no choice about whether you owe or pay your taxes. If you don’t do it voluntarily, the government can force you to pay, or just take your money from you. In fact, the possibility of negotiating tax debt violates a tenet of civilization: the law should treat everyone equally. Why should my neighbor get a better deal on paying his taxes than I do, just because he has better negotiating skills? What the IRS does have to do is apply tax law and collection efforts equally to all US citizens. The IRS sees its duty to collect every penny of tax owed.

But the US shies away from collecting every cent of tax when the taxpayer is in distress. We don’t want to see IRS agents seizing a homeless man’s change cup, nor hear of levies on widows’ pensions, to pay taxes incurred in better times. So, in 1954, Congress authorized the IRS to settle tax debts according to uniform procedures. This authorization has expanded into today’s Offer in Compromise program, which is the program the radio ads refer to.

Offer in Compromise

When a taxpayer seeks an Offer in Compromise, she moves from the realm of tax law to contract law. And contract law rests on the tenet of “consideration.” In a valid contract, each party must give up some legal right in exchange for getting something from the other. “Consideration” is what each party gives up. A taxpayer has the strict obligation to pay assessed taxes. No contract can be anchored on a taxpayer’s offer to pay taxes that she already owes; she offers no consideration. The Offer in Compromise program thus requires a work-around, some way to say that a taxpayer can offer to make a payment that does not satisfy the tax liability but that the government will say that it did anyway.

The work-around lies in the IRS’s collection standards: the IRS publishes charts that say how much money it will allow a taxpayer to live on before it starts collecting the rest of the taxpayer’s income. Thus the government refrains from collecting every dollar of taxpayer’s income, even though the taxpayer owes more money than is coming in; we allow taxpayers to function and live. In the Offer in Compromise, the taxpayer acknowledges that she owes the tax, and that the IRS can seize all her assets and the part of her future earnings that exceed the subsistence budget set by the government. The IRS calculates the worth of the taxpayer’s assets and two years of future income to determine Reasonable Collection Potential. This requires the taxpayer to divulge all their finances to the IRS. The taxpayer then offers the Reasonable Collection Potential plus one dollar– consideration! – to the IRS, asking it to take this money and, in exchange, write off the rest of the taxes she owes. She gives up a dollar to the IRS, a dollar it wouldn’t or couldn’t collect otherwise, and the IRS gives up its unquestioned power to collect the rest of the tax owing.

Disadvantages

The burden on the taxpayer is high: she must give the IRS part of her future earnings today, and the offer must provide more than the IRS could collect using all its abilities to garnish wages, put liens on assets and seize property. For this reason, the IRS approves few offers: in 2015, it approved about 27,000 out of 67,000 submitted, or 40 percent. Having reviewed thousands of offers while working for the IRS, I estimate that more than 95 percent of the offers accepted involve people who will never work again and who have very few assets. Why? Because the value of their two years of income is zero and they have few or no assets to liquidate to satisfy their tax debt.

From another perspective, Offers in Compromise are rarely accepted because it would be unfair if they were. The IRS must pursue collection of owed taxes equally. If there’s any chance a person owing taxes may be able to full pay in the future, then the IRS is obligated to wait and continue collection attempts. After all, if I full pay my taxes on time, why should my neighbor be rewarded for not paying his fair share in a timely manner? In short, the IRS won’t even consider many Offers in Compromise because they know they can get more of what’s owed by waiting for a person’s future earnings.

There are usually much better ways to deal with a large tax debt: bankruptcy, installment agreement, uncollectible status. The IRS does not like to handle offers in compromise, and I have seen them sit on a reviewer’s desk for 18 months and more with no action. Moreover, I charge more for them than for bankruptcies, because they are so time- and document-intensive.

In my experience, most tax firms that specialize in Offers in Compromise take the taxpayer’s money and do nothing – because they can’t do anything for the taxpayer. They’ll say the fee was to “analyze” the likelihood of an Offer in Compromise’s success. Don’t fall for it. It takes very little time for a good tax attorney to know if you’re one of the rare people for whom it might work. And a decent attorney would outline your other options for dealing with back taxes. So, the next time you hear about someone who can “lower your tax debt by 50, 70, even 90 percent!”, take a look at the online reviews. I bet they are not good.

April 8, 2019