In January, the IRS extended the tax return filing deadline to October 16th due to the unusually heavy precipitation last winter. Why did the IRS wait to announce the new November 16 deadline until deadline day? Wouldn’t almost everyone still needing to file on Monday have done so? Moreover, the IRS’ stated reason for this third extension is still the winter weather – which ended a half year ago! C’mon, IRS! This latest deadline IS NOT about generously giving Californians impacted by winter weather more time to file. It’s about CYA for the IRS. Read more »

October 19, 2023

Author: John Faucher

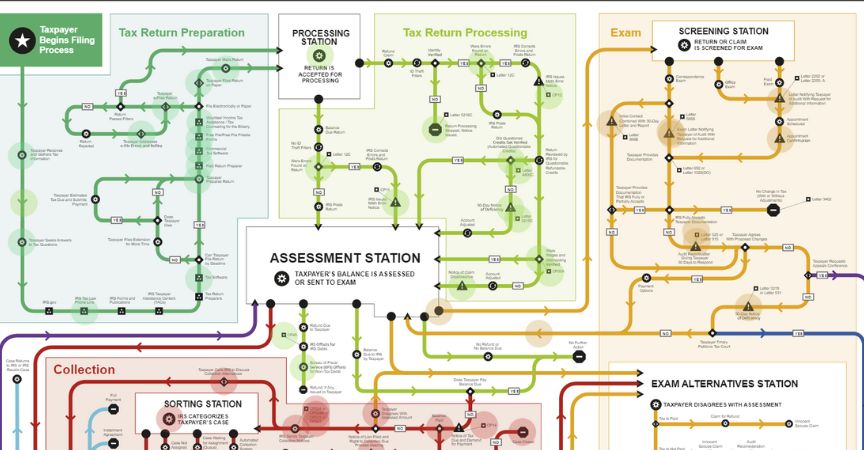

Tax Lawyers Are GPS For the IRS

People hire me because tax lawyers are like GPS for the IRS. Think you can navigate the steps in the Taxpayer Roadmap above on your own? Good luck! Looks like the subway map for NYC, right? How easy was it for you to find your way around the NYC subway system the first time you rode it? Even with a map, I’ll bet it was a challenge. The same is true of navigating the vast, intimidating bureaucracy of the IRS depicted above. Read more »

October 13, 2023

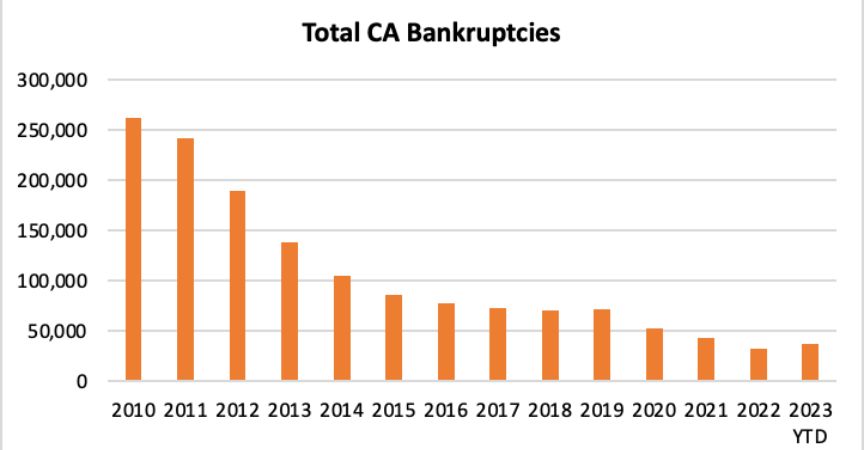

Why Are Bankruptcies Increasing?

Why are bankruptcies increasing? The trend is clear both nationwide and in California (the two track each other closely): after having declined every year since 2010, the high-water mark of Great Recession bankruptcy filings, bankruptcies are going up again. Read more »

October 6, 2023

IRS Audits a Tax Attorney – Me

What happens when the IRS audits a tax attorney, like me? Most clients don’t know this, but I have personally experienced an IRS audit . So I know all too well the stress that accompanies receiving an Audit Notice from the IRS, and the anxiety of putting together documentation and hoping I get through the audit without owing a lot more in taxes. Here’s why I was audited and how it turned out. Read more »

September 14, 2023

FTB Amnesty for Syndicated Conservation Easements and Captive Insurance Companies

California’s FTB is offering amnesty for syndicated conservation easements and captive insurance company tax deductions. Both investments are highly-sophisticated, often-fraudulent tax schemes. I’ve been getting lots of calls recently from taxpayers who invested in one of these for their generous tax write-offs, but who are now under FTB audit. If the FTB finds a syndicated conservation easement or captive insurance company investment is not legitimate, then the taxpayer is subject to a 40 percent penalty, plus a doubling of the interest rate. Unfortunately, many of these transactions are not legitimate. Read more »

August 5, 2023

Your Credit Score May Go Up When You File Bankruptcy in LA

Most of my clients are surprised when I tell them their credit score may go up when they file bankruptcy. In fact, one of the Top Three Fears of Bankruptcy I hear from clients is the negative impact it’ll have on their credit scores. This is the case especially for renters since so many property management firms and landlords check a potential tenant’s credit score before renting. Read more »

July 28, 2023

Off-Beat Things to Do in the San Francisco Bay Area

I like doing off-beat things, especially in the Bay Area (which is kind of an off-beat capital), where I’m spending more time these days. After all, my Head Paralegal is a tuxedo cat named Sebastian. So, here’s Sebastian and my lesser-known, or under-appreciated, favorite things to do in the San Francisco Bay Area. Read more »

July 21, 2023

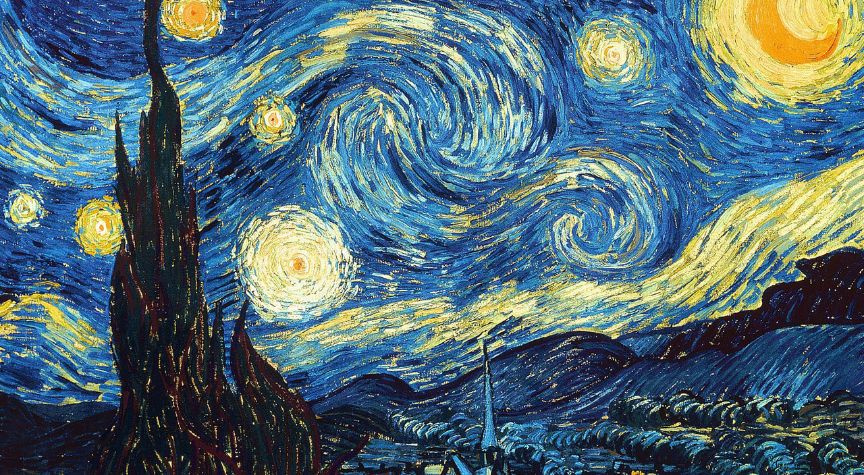

Are There Limits to Tax-Deductibility of Fine Art Donations by Artist?

Many thanks to my seatmate on a recent flight who posed this hypothetical question, worthy of a Harvard Law School Professor: if an artist sells her painting for $1 million, can she then paint an identical copy, donate it to a charity, and claim no income for the tax year, on the assumption that the value of the copy is $1 million (because that’s what she sold the original for)? The answer is “no.” Read more »

July 14, 2023

California State Bar Certificates of Specialization

As many of you may know, I hold a Certificate of Specialization in Bankruptcy Law and in a Certificate of Specialization in Tax Law from the State Bar of California. You probably also don’t see many California attorneys advertising this. That’s because fewer than five percent of lawyers in California have taken the exam and continuing legal education courses necessary to obtain this certificate. Read more »

July 7, 2023

IRS Offer in Compromise Hard to Get in Santa Barbara County

An Offer-in-Compromise is a contract between the IRS and a taxpayer to settle a tax debt for less than what is owed. I get lots of calls from folks excited at the prospect of being able to negotiate down what they owe IRS. And then I burst their bubble with the bad news: it is very hard to get an Offer in Compromise (OIC) from the IRS. Read more »

June 24, 2023