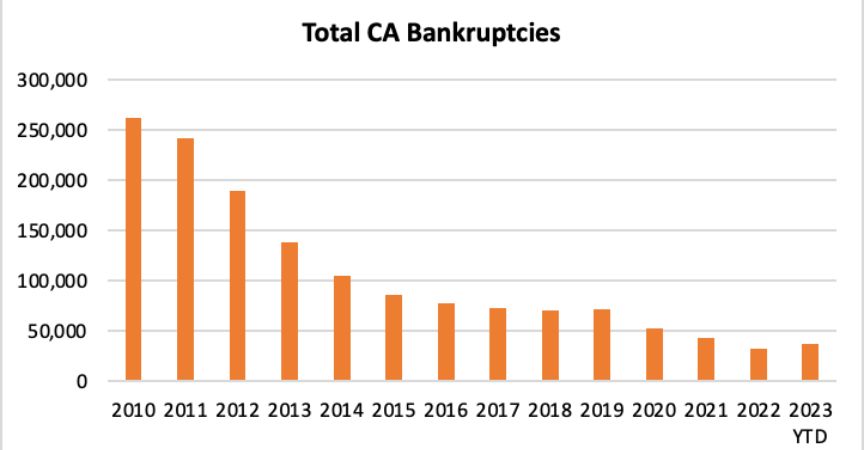

Why are bankruptcies increasing? The trend is clear both nationwide and in California (the two track each other closely): after having declined every year since 2010, the high-water mark of Great Recession bankruptcy filings, bankruptcies are going up again. The graph above, based on data from the U.S. Bankruptcy Court shows, more bankruptcies have already been filed this year-t0-date than all of 2022. When Covid began, I predicted a tsunami-like effect: bankruptcy filings would decline, returning to sea like the retreating tide because of pandemic-related supports. Then bankruptcies would come crashing back shortly after Covid-related economic support policies ended. That seems to be precisely what happened. Potential client calls to my office confirm the trend in the graph below. This time last year, 10-20% of calls were from people seeking bankruptcy (versus tax) help. Today, almost half the calls I get are for bankruptcy.

Covid-inspired Policies Over

Last fall, many of the regulations preventing landlords from evicting or suing non-paying tenants ended. I’m seeing many small business owners who broke leases during Covid because their income was slashed by stay-at-home restrictions, but whose former landlords have only this year been able to sue and get judgments. Such legal judgements are dischargeable in bankruptcy if the person meets the other income qualifications. I’m also seeing people who were sued for other matters before Covid began, but their non-rent-related lawsuits only recently ended because of the case backlogs caused by Covid shutdowns of the courts.

Debtors Wait to File Bankruptcy

Governmental support policies such as PPE and SBA loans and economic support payments surely account for why bankruptcies didn’t sky-rocket in 2020 and 2021. But bankruptcies are always a lagging indicator of economic hard times. Why? Most people struggle with debt problems for years, hoping the next quarter or year will be better, before turning to bankruptcy as a solution. Many drain savings accounts, sell assets and run up credit card debt, waiting for their financial fortunes to change. Indeed, debtors must first deplete most of their assets and resources to qualify for chapter 7 bankruptcy. My clients come to bankruptcy reluctantly; no one has ever entered my office crowing “Whee! I’m filing bankruptcy to stiff my creditors!”. What I’ve seen in the increasing number of clients needing to explore bankruptcy are people who were dealt crippling financial blows by Covid, tried mightily for several years to right their finances, and finally understand their only good alternative is to use bankruptcy to discharge their debts and start anew.

Cost of Living

I know I’m not the only person who compares pre-Covid with today’s prices and thinks “Really?!”. A simple lunch cost me $10 before Covid; it’s never less than $20 now and I’m not eating more than I used to. Water and electricity are both up over 50 percent in three years – well above the government’s “official” six percent average annual rate of inflation since 2020. By the way (and pardon a brief rant), what good is an inflation index that doesn’t include most of the things I buy regularly? A box of Costco popcorn (for the hens at Faucher Family Farms, not me) used to be $8.99; it’s almost $14 now. I hyperventilate every time I pull up to a gas pump and fuggetabout my homeowners’ insurance rates: I’m ready to torch my house myself before the next wildfire does, and I’m on the Oak Park Fire Safe Council! This crazy inflation has surely been like throwing gas on the flames of financial distress for many people, pushing them into a bankruptcy they might have avoided if the cost of living weren’t rising faster than the incoming tsunami wave of bankruptcies in this county.

If you’re having trouble managing debt, give me a call.

October 6, 2023