In a word: NO!!! Please: NO! You should never sacrifice your financial security in retirement to pay current debt. Most importantly, bankruptcy allows you to erase credit card and (most) tax debt and keep your retirement accounts. So why would anyone cash in retirement accounts they will need in the future to pay off today’s debts, if today’s debts can be discharged in bankruptcy? Because most people don’t know better. Read more »

Author: John Faucher

Scammed by a Tax Relief Firm? What to Do

Many of my tax clients come to me after being scammed by a “tax relief” firm. These bottom-feeding scammers simply take the money and then do nothing: don’t return phone calls or emails, don’t do any work. The tens of thousands of dollars they take from people seems only to be invested back into the marketing and sales machinery of these scam firms: buying more radio, television and google ads, and hiring more salespeople to sign up unsuspecting consumers. Here’s what to do when you’re hood-winked by one of these “Opti-con” tax “resolution” firms. Read more »

California Bankruptcy Trustees’ Document Portals Ranked

California Bankruptcy Trustees document portals should be ranked. And I’m doing so here, in the first annual Faucher Law ranking of bankruptcy document portals! The Bankruptcy Trustee overseeing a chapter 7 bankruptcy always requires several kinds of documents substantiating the bankruptcy petition to be submitted. This is done via web portals. But not all portals were created equal: some are easy to use and some are downright terrible. Thus, the “need” for a portal assessment. Read more »

Are You A Consumer or A Non-Consumer Debtor?

When filing a Chapter 7 bankruptcy in California, it’s important to know if you’re a consumer or a non-consumer debtor. If you’re a consumer debtor, then you need to meet the Means Test, an income threshold you cannot go above and still qualify for a chapter 7. If you’re a non-consumer debtor, then you do not need to meet the Means Test; how much you earn may, but won’t necessarily, disqualify you from filing for Chapter 7. So what? Most everyone would prefer a chapter 7 to be free and clear of their debts without going through years of repayment first. Read more »

Why was the 2022 Tax Deadline for California Extended on Deadline Day?

In January, the IRS extended the tax return filing deadline to October 16th due to the unusually heavy precipitation last winter. Why did the IRS wait to announce the new November 16 deadline until deadline day? Wouldn’t almost everyone still needing to file on Monday have done so? Moreover, the IRS’ stated reason for this third extension is still the winter weather – which ended a half year ago! C’mon, IRS! This latest deadline IS NOT about generously giving Californians impacted by winter weather more time to file. It’s about CYA for the IRS. Read more »

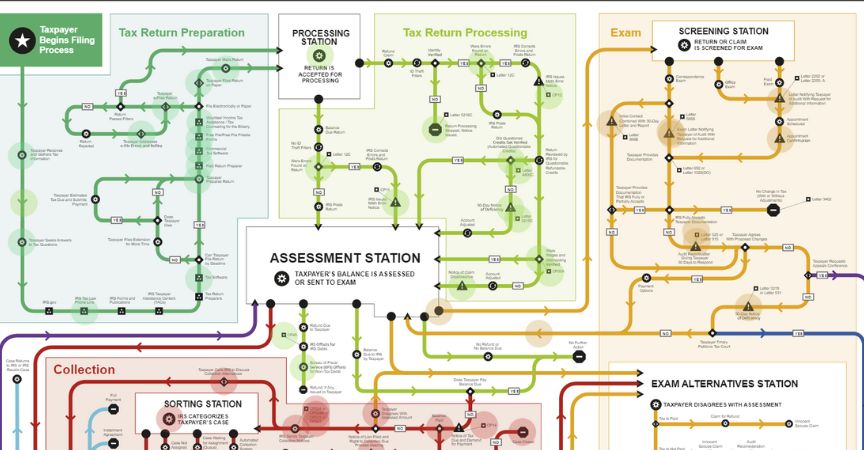

Tax Lawyers Are GPS For the IRS

People hire me because tax lawyers are like GPS for the IRS. Think you can navigate the steps in the Taxpayer Roadmap above on your own? Good luck! Looks like the subway map for NYC, right? How easy was it for you to find your way around the NYC subway system the first time you rode it? Even with a map, I’ll bet it was a challenge. The same is true of navigating the vast, intimidating bureaucracy of the IRS depicted above Read more »

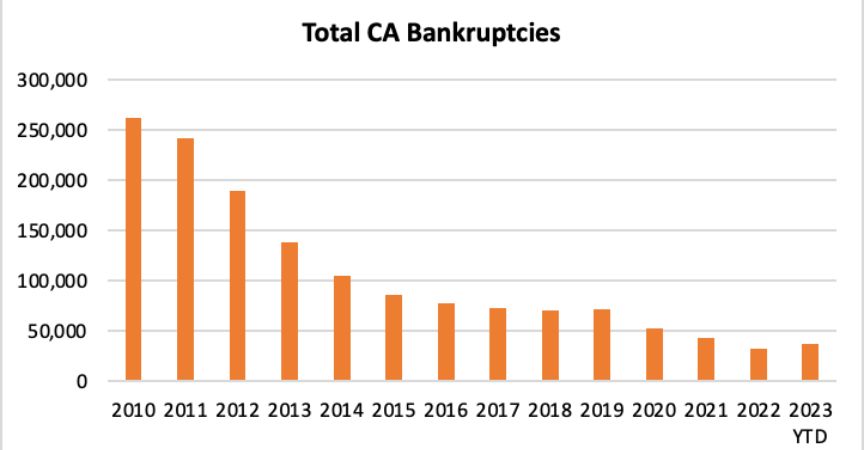

Why Are Bankruptcies Increasing?

Why are bankruptcies increasing? The trend is clear both nationwide and in California (the two track each other closely): after having declined every year since 2010, the high-water mark of Great Recession bankruptcy filings, bankruptcies are going up again. Read more »

IRS Audits a Tax Attorney – Me

What happens when the IRS audits a tax attorney, like me? Most clients don’t know this, but I have personally experienced an IRS audit . So I know all too well the stress that accompanies receiving an Audit Notice from the IRS, and the anxiety of putting together documentation and Read more »

FTB Amnesty for Syndicated Conservation Easements and Captive Insurance Companies

California’s FTB is offering amnesty for syndicated conservation easements and captive insurance company tax deductions. Both investments are highly-sophisticated, often-fraudulent tax schemes. I’ve been getting lots of calls recently from taxpayers who invested in one of these for their generous tax write-offs, but who are now under FTB audit. If the FTB finds a syndicated conservation easement or captive insurance company investment is not legitimate, then the taxpayer is subject to a 40 percent penalty, plus a doubling of the interest rate. Unfortunately, many of these transactions are not legitimate Read more »

Your Credit Score May Go Up When You File Bankruptcy in LA

Most of my clients are surprised when I tell them their credit score may go up when they file bankruptcy. In fact, one of the Top Three Fears of Bankruptcy I hear from clients is the negative impact it’ll have on their credit scores. This is the case especially for renters since so many property management firms and landlords check a potential tenant’s credit score before renting. Read more »