California’s Franchise Tax Board (FTB) publishes a Most Wanted List of delinquent California taxpayers on its website, for both individuals and corporations. The FTB’s Most Wanted List includes the taxpayer’s name, address and amount owed. In order to qualify for placement, a taxpayer must owe the FTB at least $100,000. I guess simply owing $99,000 is insufficient to merit placement on the list and the free “publicity” that comes with it. The list is updated twice annually, or whenever a taxpayer on the list has paid up and their name comes off.

What’s the Purpose of the FTB’s Most Wanted List?

The California State Legislature ordered the FTB to publish the names of the 500 biggest tax cheats (Revenue & Taxation Code, Section 19195), believing that public shaming induces people to pay up. I’m not convinced this tactic increases compliance with California tax laws, but I’ll leave that for another blog. I will note that the IRS doesn’t publish a Most Wanted List, preferring to use “carrots” to get taxpayers to pay back taxes, rather than “sticks”. The IRS’ reasoning is that antagonizing taxpayers reduces the legitimacy of the IRS, something it avoids because it is above all else a law enforcement agency.

Problems with the FTB’s Notice of Public Disclosure of Tax Deliquency

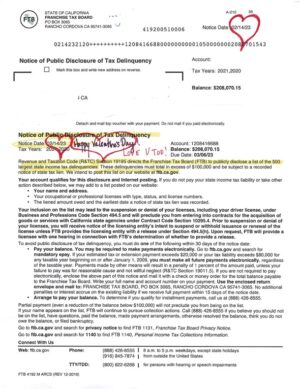

I have several clients who have received the FTB’s Notice of Public Disclosure of Tax Deliquency. Here’s one a client was lucky enough to receive on Valentine’s Day, which I thought was a novel way to mix up simply getting a loved one a card and flowers.

Ooops- am I sounding snarky? Yup. Here’s the problems with this Notice and with the FTB’s Most Wanted List.

FTB Divisions Not Communicating

In the case of the client the Notice above was sent to, he’s a small business owner. He’d been making Installment Plan payments to the FTB for about a half year, and then failed to make a payment. Why? His business experienced a bad month and he didn’t have the money. His business’ troubles continued the next month and he again failed to make full payment. I called the FTB, explained the situation, and asked to renegotiate the amount of my client’s monthly Installment Agreement payments.

The FTB agent had us fill out a new Collection Information Statement (standard procedure) and okayed a lower amount. AFTER the FTB agent in the Most Wanted Division said everything was okay, my client received this notice from the Collections Division. Huh? The Most Wanted Division didn’t let the Collections Division know about the updated Installment Agreement and the fact that my client was back in compliance? What’s going on? Maybe the California Legislature needs to write inter-agency communication policy into the California Tax Code, because I don’t think these guys at the FTB are figuring it out on their own.

30 Days is Unreasonable Response Timeframe

The FTB website says a taxpayer has 30 days to avoid being placed on the list. That’s a short period of time for a taxpayer to come into compliance, particularly when it can take hours on hold to reach an FTB agent, and then weeks to have an Installment Agreement approved by the FTB agent. The Notice of Public Disclosure of Tax Delinquency was the first notice my client received, almost three months after he first failed to make full payments on his Installment Agreement. It makes no sense for the FTB to need 90 days to send a notice, but expect taxpayers to come into compliance in 30 days.

Moreover, what’s the rush? Doesn’t the FTB want to do everything in its power to get Californians to comply with tax laws? What if someone was in the hospital? Or traveling? Or taking care of a loved one who was seriously or terminally ill? Is it just me, or is 30 days an unreasonable time frame for many of us to respond?

Confusing FTB Notices

The first Notice my client received from the FTB was the above Notice of Public Disclosure of Tax Delinquency. I think they should have sent out a Notice of Delinquency or, at worst, a Notice of Proposed Tax Levy first. Threatening my client with the Most Wanted Listed first, especially when my client HAD BEEN IN AN INSTALLMENT AGREEMENT demonstrating his desire to be in compliance, feels like a nuclear response. For what? How does the FTB gain from this? I’m guessing most of us would be more cooperative if we received less threatening notices first, giving us a chance to explain and correct.

Has the FTB Threatened to Place You On Its Most Wanted List? Call Me!

June 19, 2023