Tax debt is dischargeable in bankruptcy. However, unlike many other nondischargeable debts (fraud, malicious tort, etc.), tax debt may actually remain in force with no further word from the court. Huh? The IRS or the FTB could come back five years after the discharge and start collecting on taxes Read more »

Author: admin@faucherlaw

Why IRS Doesn’t Negotiate Payroll Tax Debt – EVER

Business owners with payroll tax debt often ask me why the IRS won’t lift its levy or lien. After all, these clients argue, I just need a bit of free cash to invest back into my business, to make the money to pay what I owe. If the IRS cripples my business with liens or levies, then I can’t make the money to repay them. So, why doesn’t the IRS act more like my business partner, let me continue to operate, and make the money to pay them back Read more »

What Happens at a Bankruptcy 341 Meeting of Creditors?

In chapter 7 bankruptcy, everything you own and owe is briefly transferred to a bankruptcy Trustee, who can then use your assets to pay your debts. If you have more debts than assets, then those debts are “discharged” or wiped out (there are exceptions for some debts… Read more »

Traffic Tickets Dischargeable in Ch. 13 Bankruptcy But Not Ch. 7

You file bankruptcy to get rid of debts you can’t afford to pay and to get the fresh financial start in life that you so desperately need. But not all debts can be wiped out in your bankruptcy. Read more »

Private Tax Debt Collectors & Vultures…

I recently got a letter from Pioneer Credit Recovery of Horseheads, New York (population 6,461), telling me that it was taking over one of my clients’ accounts from the IRS. Read more »

Homestead Exemption Increased; Now Easier to File Chapter 7 Personal Bankruptcy

California just became a much more debtor-friendly state. Specifically, most people filing chapter 7 personal bankruptcy no longer risk losing a house in which they have substantial equity. On September 18th, Governor Read more »

Reynolds & Reynolds CEO Charged With Hiding $2 Billion from IRS – Biggest U.S. Tax Evasion Ever

I saw this article originally in the Wall Street Journal, front page. But, I’m posting from the New York Times, because it’s not behind a paywall. $2 billion in hidden income? C’mon Robert Brockman – Read more »

IRS Audit Challenge – Tax Bill of $203,000 Owed Reduced to $1,500 for Santa Barbara County Wine Merchant

A merchant who buys and sells wines through an LLC that shows up as a Schedule C business on his personal tax return was recently audited. The IRS claimed he Read more »

“Preferential” Repayments to Creditors Before Bankruptcy: the Case of Family Members

Many of my bankruptcy clients want to know what will happen if they repay a family member before filing bankruptcy. It’s an important and common question I just faced. My Read more »

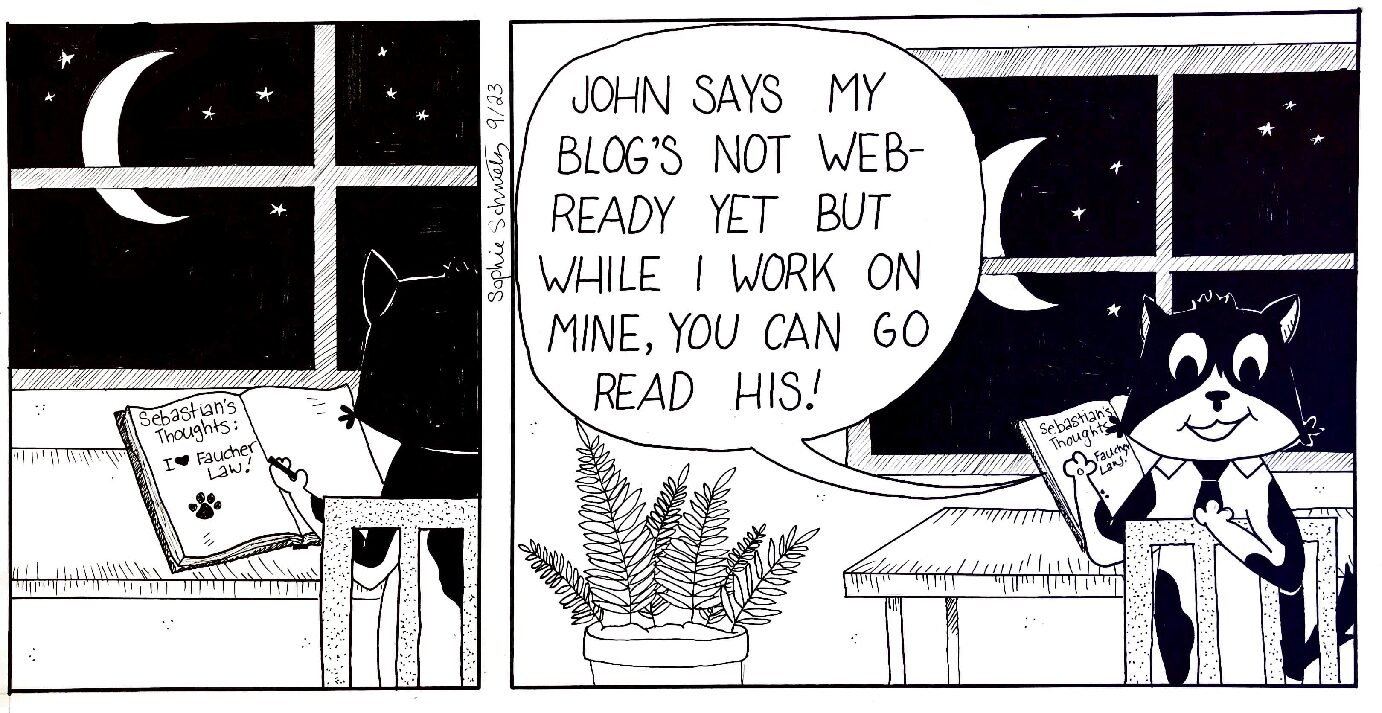

Sebastian the Paralegal Recommends John’s Tax and Bankruptcy Law Blog

Hi, Sebastian the Feline Paralegal here. “The boss” John, tax and bankruptcy lawyer, says my blog’s not web-ready yet, which I think is ridiculous…see my tired paws??? But while I plead my case, feel Read more »