Hi, Sebastian the Feline Paralegal here. “The boss” John, tax and bankruptcy lawyer, says

my blog’s not web-ready yet, which I think is ridiculous…see my tired paws??? Read more »

September 29, 2020

Blog

Which Tax Authorities Touch Californians?

The U.S. federal and California state governments fund their activities by imposing and collecting taxes on various transactions. Read more »

September 22, 2020

Why Choose Faucher Law?

Here’s a summary of how I practice law and what I promise my clients. Note: the first letters of each paragraph form my last name, Faucher. Read more »

September 15, 2020

IRS Mail Backlog, and US Government

Like so many businesses, the IRS shut down most of its operations during the early months of the pandemic, returning to full work only in early July. Read more »

September 4, 2020

Tax and Bankruptcy Lawyer John Faucher – Did You Know….?

Tax and Bankruptcy lawyer John Faucher is also an intrepid chicken farmer. The flock of Faucher Family Farms has ranged from six to sixteen hens (no roosters – too loud), and currently stands at thirteen. Read more »

August 31, 2020

Why Are 2020 Bankruptcies Down, Not Up?

Bankruptcy filings have declined nationwide this year – a counterintuitive trend given the economic gut punch from the Covid-19 pandemic. In the Central District of California, which includes much of Los Angeles, Ventura and Santa Barbara counties, there have been only 18,381 bankruptcy filings so far this year. Read more »

August 21, 2020

Bankruptcy Usually Won’t Get Rid of Student Loan Debt

If your student loans went to pay tuition, room & board, or school supplies, then that debt is probably not dischargeable in bankruptcy. Read more »

August 17, 2020

Small Business Chapter 11 Bankruptcies Faster and More Affordable!

Sadly, the economic slowdown caused by Covid-19 is making many small business owners consider bankruptcy. Indeed, the Small Business Association estimates 40% of the US’s 30 million small businesses will fold within a year. Read more »

August 10, 2020

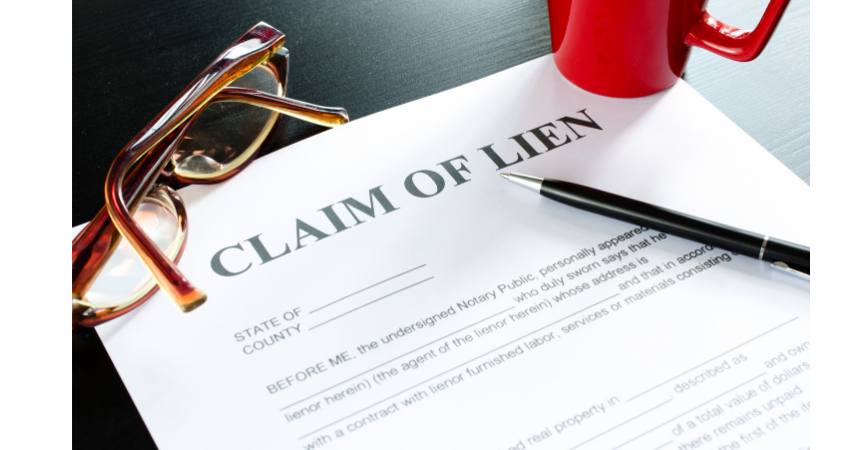

What Happens to Liens in Bankruptcy?

A lien is a creditor’s legal right to a debtor’s specific property to satisfy a debt. The most common lien is a home mortgage. The homeowner borrows money from a bank to buy a house and signs a deed of trust which allows the bank to foreclose if the homeowner stops paying the mortgage. Read more »

Reaffirming Debt in Bankruptcy

In bankruptcy, all of a debtor’s debts and assets are brought into the case. The debtor does not choose which assets are used to pay debts, or which creditors get stiffed or get paid. Read more »

July 17, 2020