Timing matters in bankruptcy. For example, if you have seasonal fluctuations in income (like teachers and realtors), then at some times of year your income may be too high to qualify for bankruptcy. But, if you wait a few months, your low-season income may qualify you. Read more »

May 20, 2021

Blog

How Inheritance Impacts Bankruptcy

It’s horrible to have a loved one die. But sometimes the death comes with a silver lining in the form of an inheritance. However, for someone with lots of debt who’s considering bankruptcy, an inheritance is a mixed blessing. It’s money that their creditors want, and are legally entitled to take. Read more »

May 12, 2021

Considering Bankruptcy? Tip 4 – Good for Tax Debt But Not Student Loan Debt

Bankruptcy Will Allow You to Get Rid of Most State & Federal Income Tax Debt. In fact, this why I practice tax and bankruptcy law – because bankruptcy can be used in some cases to get rid of tax debt. Read more »

May 7, 2021

Considering Bankruptcy? Tip 3 – Stop Worrying About Credit Score Hit

One of the biggest concerns people have about bankruptcy is triggering a negative hit to their credit score. The anxiety that their credit score will go down even stops some people from filing bankruptcy to cancel debt. Don’t be one of them. Here’s four reasons to stop worrying about your credit score. Read more >>

April 30, 2021

IRS Processing Times Still Covid-Slow

It’s late April. More than 13 months into the pandemic. Almost 40% of Americans have received at least one Covid vaccine. So, you’d think IRS processing times – which slowed to a virtual crawl when the pandemic hit – would be starting to improve, right? Guess again. Read more >>

April 26, 2021

Considering Bankruptcy? Tip 2 – Don’t Worry About Losing Everything

Many people are concerned that filing for personal bankruptcy means losing everything they own. After all, in a chapter 7 bankruptcy, everything you own and owe is legally transferred to a Bankruptcy Trustee, who can then use your assets to pay your debts. Read more >>

April 19, 2021

Tales From the Tax Troll Trenches: IRS Says Don’t Use US Mail

As readers of my Newsletter and Blog know, dealing with the IRS daily means I uncover unreasonable policies and bizarre agents at the IRS on a regular basis (and don’t even get me started on the policies and personnel of the California Tax agencies, who make the IRS seem highly efficient and professional). Read more >>

April 12, 2021

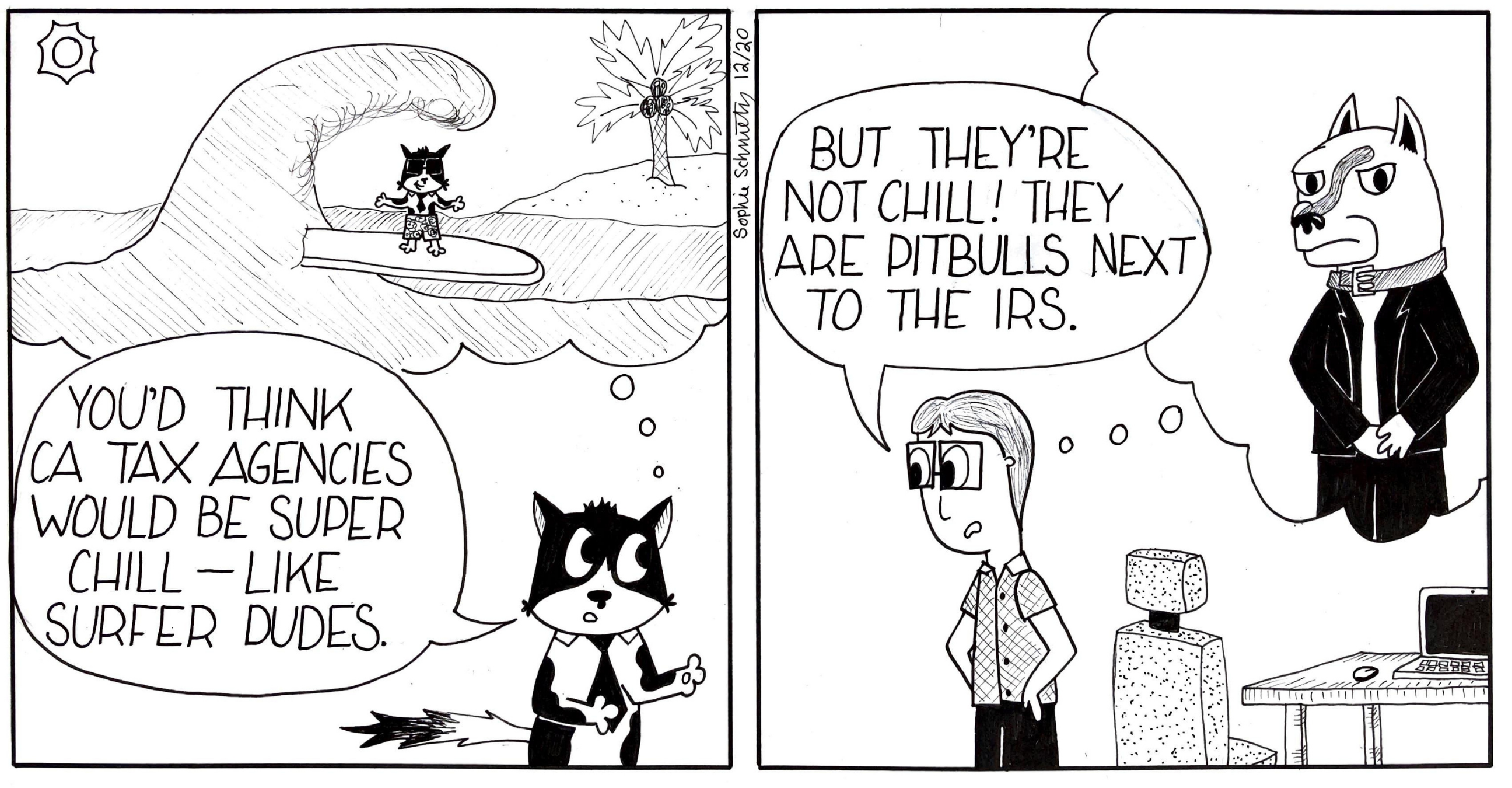

Installment Agreement for Tax Debt: Much Harder To Set Up with California’s FTB than the IRS

My website outlines the many ways in which the California tax agencies (Franchise Tax Board, CA Department of Tax & Fee Administration, Employment Development Division) are FAR harder to deal with, and aggressive in their tax collection attempts, than the IRS. Read more >>

April 13, 2021

Considering Bankruptcy? Tip 1 – Speak To Someone Sooner Rather Than Later

Readers of my Newsletter already know that, since Covid began, I have seen a steep decline in bankruptcy clients. Seems counterintuitive, no? After all, many prominent retailers and large corporations have already filed Chapter 11 Business Bankruptcy reorganization. Read more >>

April 5, 2021

Faucher Family Farms – Where Hens Are Workers

This Washington Post article, about a doctor’s flock of backyard chickens, prompts today’s update on my hens. Read more >>

April 1, 2021