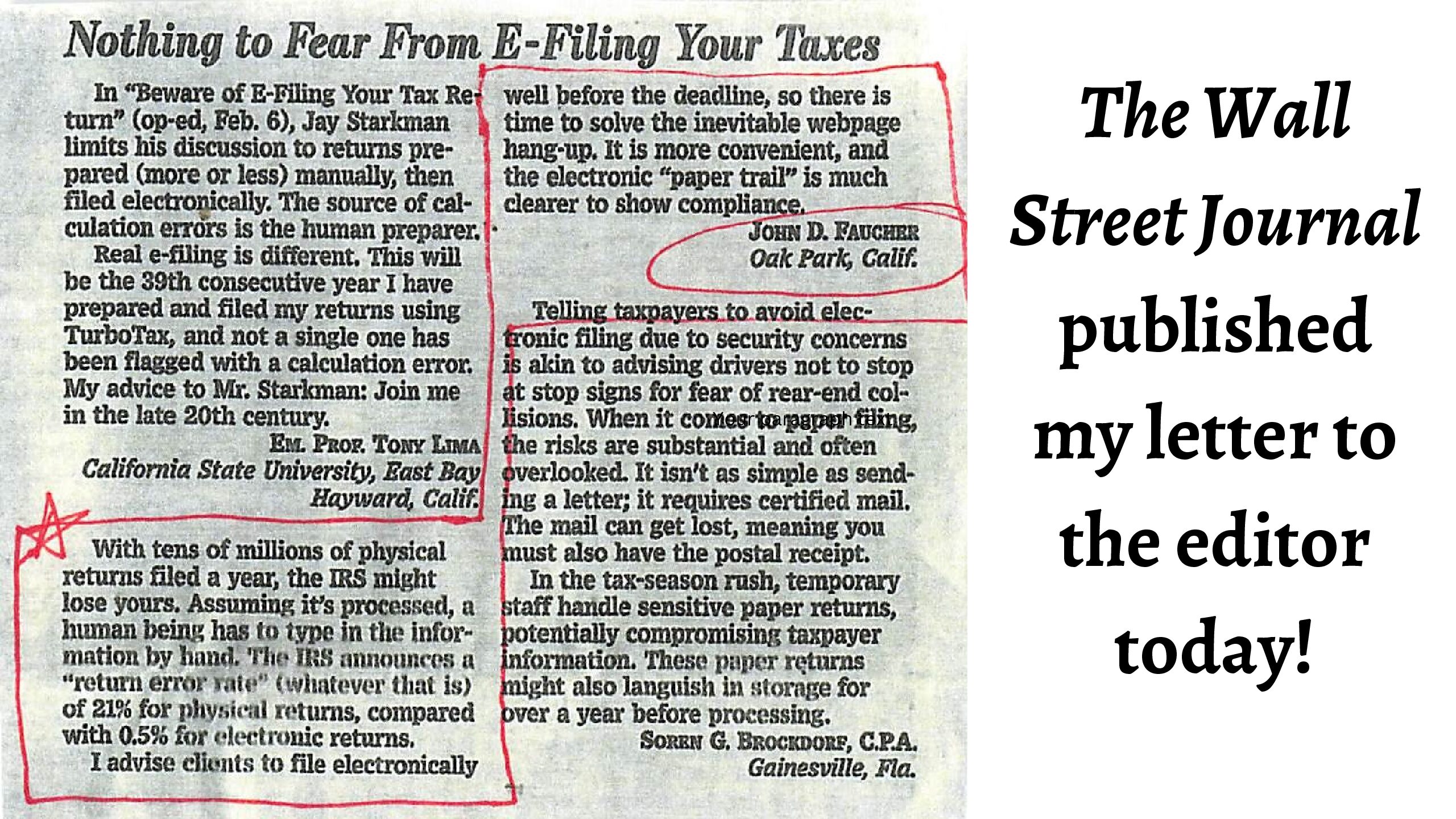

The Wall Street Journal published me in their Letters to the Editor section today (February 14, 2024:A14)! I was responding to a February 5th Op-Ed by Jay Starkman, telling taxpayers to avoid filing their tax returns electronically. I strongly disagree. You can read about why on my website, and now also in the Wall Street Journal to find out why. Here’s what the Journal published today:

Faucher Disagrees Electronic Filing of Tax Return Should Be Avoided

“With tens of millions of physical returns filed a year, the IRS might lose yours. Assuming it’s processed, a human being has to type in the information by hand. The IRS announces a “return error rate” (whatever that is) of 21% for physical returns, compared with 0.5% for electronic returns.

I advise clients to file electronically well before the deadline, so there is time to solve the inevitable webpage hang-up. It is more convenient, and the electronic “paper trail” is much clearer to show. – John Faucher, Oak Park, CA”

February 14, 2024