No, your bank likely will not close your checking or savings account if you file bankruptcy. This often confuses my clients because I warn them that all their credit cards will be closed within days of filing a bankruptcy. What accounts for this difference? Read more »

March 2, 2026

Bankruptcy Aftermath

How Public Is the Information in a Bankruptcy?

Many clients worry about how public the information in a bankruptcy will be: who gets or can see the information in their personal chapter 7 bankruptcy? After all, when a person files bankruptcy, they are filing a 50-plus-page Petition that lays bare *all* of their income, assets, debts and financial transactions for the past 1-3 years. Since all bankruptcies are legal filings with the US Bankruptcy Court, they are public documents and, by definition, accessible to anyone. In reality, however, very few people have their bankruptcy found or seen by anyone other than the creditors listed in their bankruptcy Petition. Read more »

February 17, 2027

My Time at Faucher Law by Paris

Before I started at Faucher Law, I was finishing up my MSA (master of science in accounting) at San Diego State University. When I used to tell people about my accounting background, they asked if I liked tax, and my answer was always NO! Now here I am, half a year later, switching my answer: I kind of love tax! Listed below are the most surprising things I have learned at my time at Faucher Law and how they have changed my perspective on tax and bankruptcy. Read more »

February 12, 2024

Celebrity Bankruptcy

You’d be surprised how many famous people, whom we consider wildly successful, have gone through financial turmoil and bankruptcy. Many of them went on to be wildly successful after bankruptcy. Read more »

February 6, 2024

Your Credit Score May Go Up When You File Bankruptcy in LA

Most of my clients are surprised when I tell them their credit score may go up when they file bankruptcy. In fact, one of the Top Three Fears of Bankruptcy I hear from clients is the negative impact it’ll have on their credit scores. This is the case especially for renters since so many property management firms and landlords check a potential tenant’s credit score before renting. Read more »

July 28, 2023

Bliss After Bankruptcy

For many people, going through bankruptcy turns out to be the one of the best things they’ve ever done. So much so, it makes them blissful to recount why…. Read more>>

September 9, 2022

Why Bankruptcy Attorneys Shouldn’t Accept Credit Cards

I don’t take credit cards. I don’t think it’s ethical, and here’s why Read more »

December 29, 2021

How the DOJ Can Mess Up Getting Rid of Tax Debt in Bankruptcy

Tax debt is dischargeable in bankruptcy. However, unlike many other nondischargeable debts (fraud, malicious tort, etc.), tax debt may actually remain in force with no further word from the court. Huh? The IRS or the FTB could come back five years after the discharge and start collecting on taxes Read more »

November 24, 2021

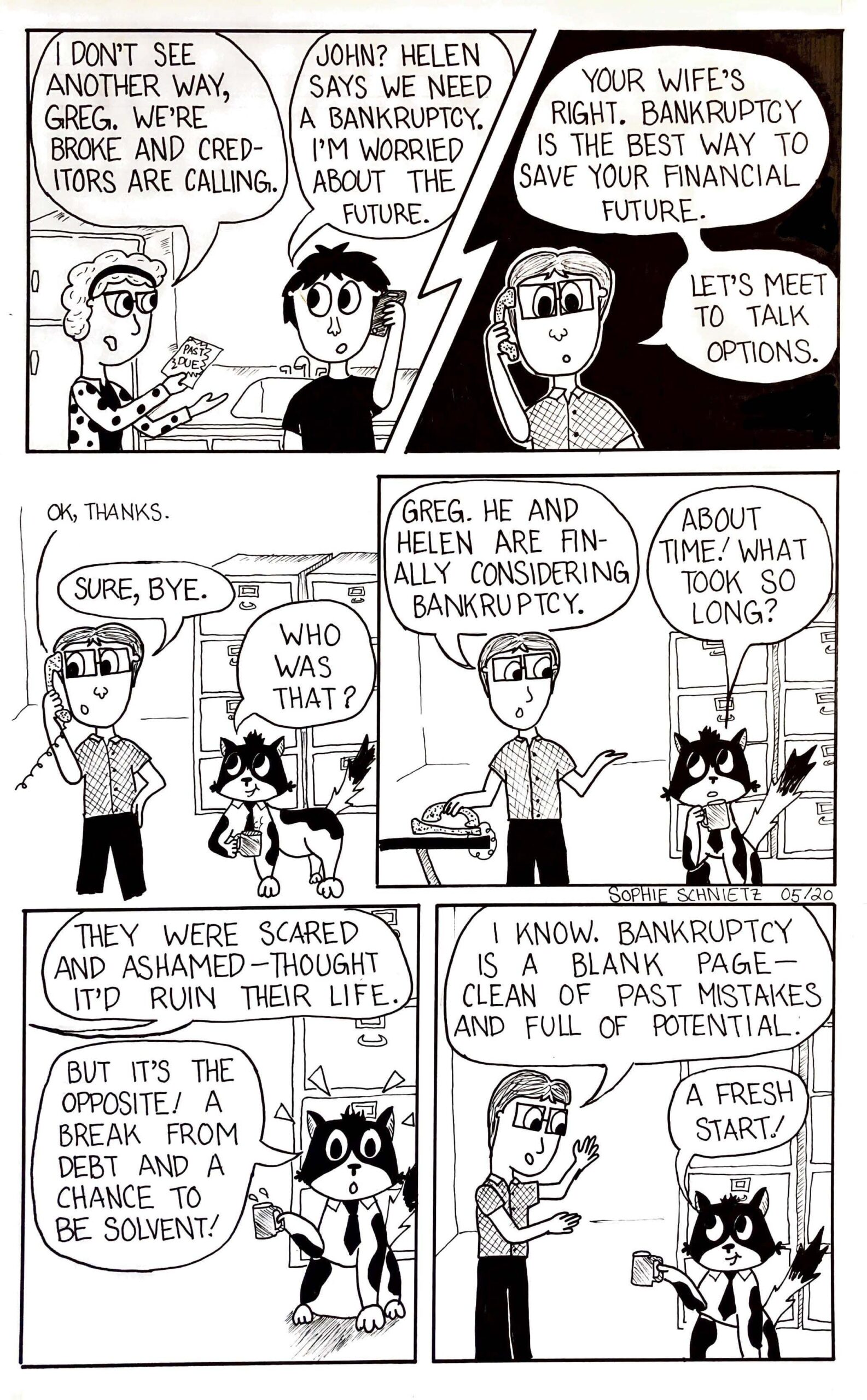

Sebastian On Why Bankruptcy Is One of The Best Things You’ll Do

Many of my clients are embarrassed to be considering bankruptcy. I get it. But there’s a huge upside to bankruptcy. Don’t trust me? Why not see what Sebastian, my Feline Paralegal, has to say Read more »

June 29, 2021

Considering Bankruptcy? Tip 6 – Don’t Feel Ashamed

Many clients feel shame about filing for bankruptcy protection. I can tell because they tell me repeatedly that they never thought they would be talking to a lawyer about bankruptcy, or that they fully intended to and still intend to pay their debts. Read more »

June 1, 2021