Musk’s DOGE team wants access to the IRS database of all taxpayer records. Why? The purported purpose of DOGE is to root out bureaucratic inefficiency in the federal government. But will DOGE access to extremely sensitive and personal financial information on every taxpayer in the country eliminate government waste? Or, perhaps, is granting DOGE access to taxpayer records a way for the current administration to gain information on political enemies? Read more>>

February 17, 2025

Author: John Faucher

Car Lenders and Customers Who File Bankruptcy

What happens to cars in bankruptcy? Or cars with notes? After all, almost everyone filing bankruptcy has a car. And cars are usually one of the larger assets a debtor owns. The answer depends on what a car is worth, whether it’s been paid off, and whether the car lender requires a Reaffirmation Agreement. Read more »

November 20, 2024

When Can Your Congressmember Help with the IRS?

It’s election season, so Congress is on my mind. Occasionally, I have called on my client’s Representative to get what I need from the IRS. And every time, the IRS has responded to the congressmember immediately, whereas I was often ignored for months. Why and when does this work? Read more »

November 7, 2024

Tax Collection Statute of Limitations

Both the Internal Revenue Service (IRS) and the California’s Franchise Tax Board (FTB) have Statute of Limitations on tax collections. The Statute of Limitations refers to the period of time during which the IRS and FTB can legally collect taxes, penalties, and interest from a taxpayer. Once the Statute of Limitations clock runs out, then what remains owing on the tax debt is erased. For federal taxes, the IRS’ clock on legal ability to collect taxes is 10 years. For California state taxes, the FTB’s clock is 30 years. But, there are things that stop the clock, thus extending the time the tax agency has to collect the tax liability. Read more »

September 20, 2024

Can the IRS Take Tax Refunds For Taxes Discharged in Bankruptcy?

“I thought I discharged my back taxes in bankruptcy! But the IRS just took this year’s tax refund and applied it to a year that was discharged!” is something I hear all the time. Yes, the IRS can do this, and here’s why. The good news? You’ll get that refund back next year. Read more »

September 12, 2024

Tax Consequences of Pig Butchering Scams

I am outraged by pig-butchering scams, the contact-intensive fraud executed via fake profiles on social media sites meant to fatten victims, like pigs before slaughter. Victims of this scam have come to me for help dealing with the taxes that are invariably triggered when victims’ cash out retirement and investment accounts. That’s right: victims of pig-butchering scams not only lose retirement savings, investments and real property to scammers, but they also end up owing the IRS and California’s FTB hefty taxes on investment income! Read more »

August 16, 2024

A Brief History of Bankruptcy in America

My clients often ask me in fits of frustration: how did bankruptcy get to be like this? And I then have the chance to tell them about the storied history of bankruptcy! Usually, they ask this question out of rage at the sheer number of documents they’re asked to produce, but I take it as an opportunity to share the joys of tax law (that is not sarcasm, I love what I do).

But I figured we can all benefit from learning something about the history of bankruptcy. So, I wanted to share with you all some of the greatest developments. What follows is a brief history laid out by the major laws that we’ve created surrounding bankruptcy.

IRS’ Instagram Account – Biggest Surprises

Faucher Law recently hired a terrific, new Administrative Assistant. Zoe came up to me the other day and asked “John! Have you seen the IRS’ Instagram account?! And it’s quite good.” Um, no. I didn’t even know the IRS had an Instagram account. I asked Zoe to tell us what she thought about the IRS’ Instagram account. Here’s her take. Read more »

February 29, 2024

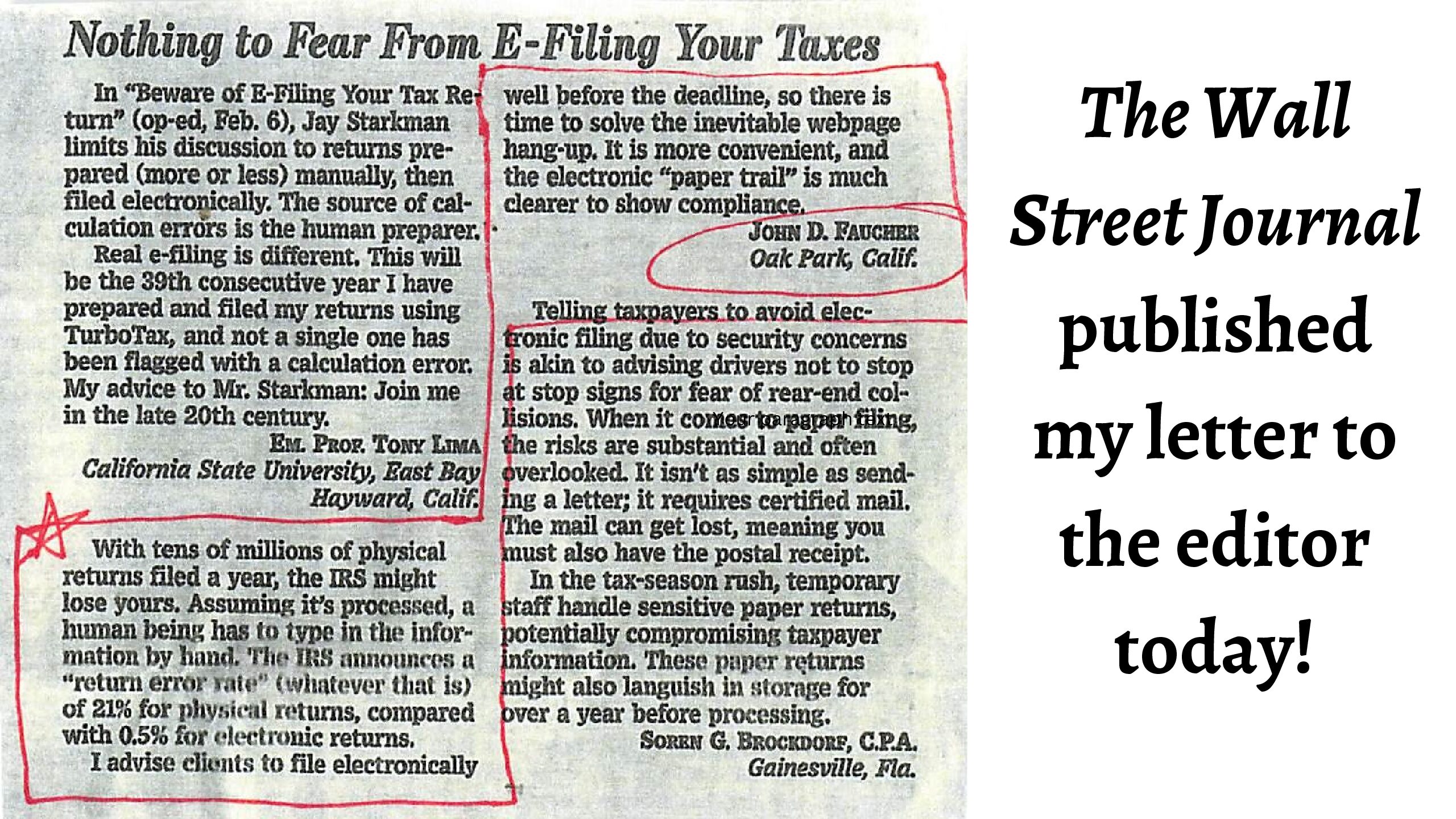

John Faucher Published in Wall Street Journal Today!

The Wall Street Journal published me in their Letters to the Editor section today (February 14, 2024:A14)! I was responding to a February 5th Op-Ed by Jay Starkman, telling taxpayers to avoid filing their tax returns electronically. I strongly disagree. Read more »

February 14, 2024

My Time at Faucher Law by Paris

Before I started at Faucher Law, I was finishing up my MSA (master of science in accounting) at San Diego State University. When I used to tell people about my accounting background, they asked if I liked tax, and my answer was always NO! Now here I am, half a year later, switching my answer: I kind of love tax! Listed below are the most surprising things I have learned at my time at Faucher Law and how they have changed my perspective on tax and bankruptcy. Read more »

February 12, 2024