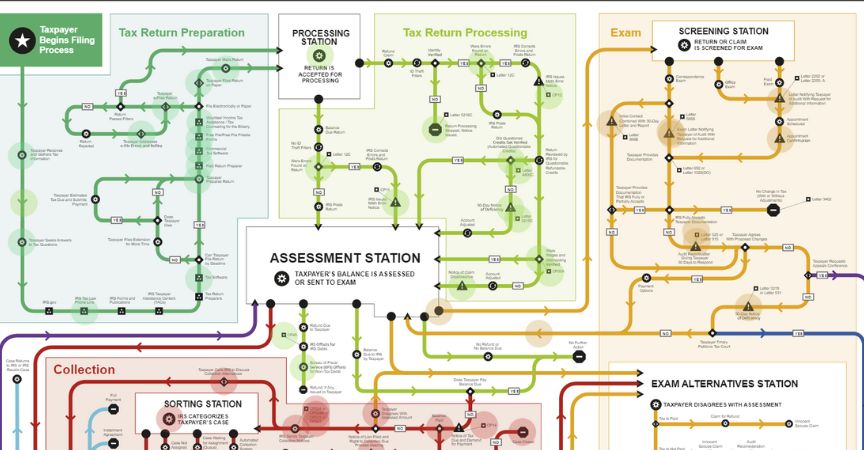

People hire me because tax lawyers are GPS for the IRS. Do you think you can navigate the steps in the Taxpayer Roadmap above on your own? Good luck! Looks like the subway map for NYC, right? How easy was it for you to find your way around the NYC subway system the first time you rode it? Even with a map, I’ll bet it was a challenge.

The Taxpayer Roadmap

The same is true of navigating the vast, intimidating bureaucracy of the IRS depicted above, especially if you’ve never done so before. And a map isn’t going to help much because it doesn’t provide a lot of critical information or nuances about the IRS such as:

- Offers-in-Compromise being almost impossible to get approved unless you’re disabled or elderly;

- the most important things to know and get right in an audit;

- how the fact that the IRS sees itself primarily as a law enforcement agency, rather than a collection agency, impacts how you should negotiate with IRS auditors and collections agents;

- how to ask for Uncollectible Status;

- whether the IRS agent you’re speaking with is giving you the correct information (often, they’re not and there’s no consequence to the agency for bad advice). In fact, I’m guessing the Taxpayer Roadmap confuses more than it illuminates.

Who puts out The Taxpayer Roadmap? The Taxpayer Advocate, a quasi-independent unit of the IRS. A buddy of mine from my days as an IRS attorney recently sent me this. Apparently, a paper, poster-sized version of it is available (just in time for the holidays)! To order, call 800-829-3676 and request Publication 5341. I loved that he sent me this because this map illustrates better than words can why navigating the IRS is so complex and confusing for most taxpayers. Which leads to why tax attorneys are like GPS for someone with an IRS problem.

Why You May Need GPS When Dealing with the IRS

Would you drive in a foreign country with bad signage and unfriendly locals speaking Klingon without GPS, or at least a map? I hope not. The same should be true of the IRS and the FTB – enormous bureaucracies with impenetrable rules and terms, sometimes-inept agents, and extreme power. I wish every taxpayer could navigate an audit, lien, levy, or repayment of back taxes on their own. But many cannot. Most people need at least a bit of guidance understanding and navigating the IRS and FTB. Tax lawyers, especially ones like me who used to work at the IRS, know what the solution to your problem looks like and how to get the desired outcome in the fastest, easiest and cheapest way. Hiring a tax lawyer may seem costly (and it often is) but it also could save you far more in taxes than what you spend to hire someone like me.

Have back taxes you cannot full-pay? Got an audit result you’re unhappy with? Has the IRS or FTB levied on your accounts or put a lien on your home? Call me and let’s discuss the possible strategies that will work to lessen this stress.

October 13, 2023