I’d like to share with you all an excerpt from the Tax Code of John Faucher and Family. I hope this spurs some discussion and thought on the Tax Codes of your own families. And if, in reading this, you realize you may have gone a few years without paying all your feline taxes, give me a call, we can see if a cat creditor bankruptcy could get some of those debts discharged.

Blog

IRS’ Instagram Account – Biggest Surprises

Faucher Law recently hired a terrific, new Administrative Assistant. Zoe came up to me the other day and asked “John! Have you seen the IRS’ Instagram account?! And it’s quite good.” Um, no. I didn’t even know the IRS had an Instagram account. I asked Zoe to tell us what she thought about the IRS’ Instagram account. Here’s her take: Read more »

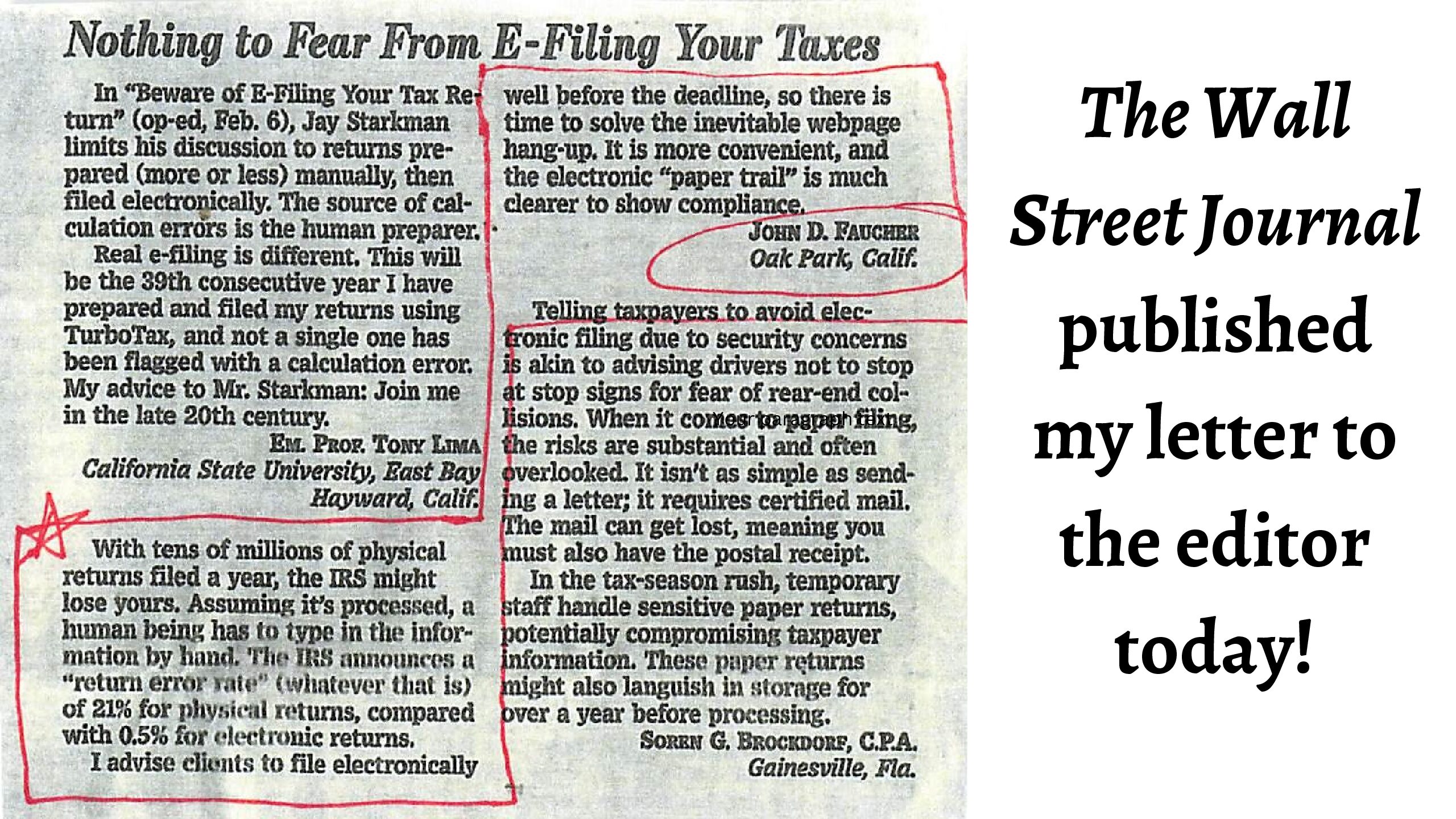

John Faucher Published in Wall Street Journal Today!

The Wall Street Journal published me in their Letters to the Editor section today (February 14, 2024:A14)! I was responding to a February 5th Op-Ed by Jay Starkman, telling taxpayers to avoid filing their tax returns electronically. I strongly disagree. Read more »

My Time at Faucher Law by Paris

Before I started at Faucher Law, I was finishing up my MSA (master of science in accounting) at San Diego State University. When I used to tell people about my accounting background, they asked if I liked tax, and my answer was always NO! Now here I am, half a year later, switching my answer: I kind of love tax! Listed below are the most surprising things I have learned at my time at Faucher Law and how they have changed my perspective on tax and bankruptcy.

Celebrity Bankruptcy

You’d be surprised how many famous people, whom we consider wildly successful, have gone through financial turmoil and bankruptcy. Many of them went on to be wildly successful after bankruptcy. Read more »

341 Meeting Questions You’ll Be Asked

Wondering what you might be asked in a 341 Meeting of the Creditors? This Chapter 7 meeting with trustees and creditors can loom large in the minds of some of my clients. Let me demystify what you’ll have to answer in this quick, painless meeting. Read more »

Best Museum Rooms

The best museums transport me to different times and places. Sometimes, just a single room or even display in a museum is all I need to get my museum “fix.” Indeed, here are some of my favorite museum rooms: I would be entirely happy visiting this museum if I were limited to seeing just this one room. Read more »

My Favorite Museum Restaurants

I love museums and I love to eat. Here are my favorite museum restaurants, locally –in Southern California– in the greater United States and even abroad! Read more »

What Happens to Cars in Bankruptcy?

What happens to cars (and car notes) in bankruptcy? After all, almost everyone filing bankruptcy has a car and it is often one of the larger assets a debtor owns. The answer depends largely on how much equity the debtor has in the vehicle. Read more »

Favorite Christmas Traditions

Merry Christmas! I’m here to share my favorite Christmas traditions. Sebastian, my Feline Paralegal, is still steamed I made him dress at Santa for the Faucher Law office Christmas party. Read more »